45 coupon on a bond

How Do Zero Coupon Bonds Work? - SmartAsset A zero coupon bond doesn't pay interest, but it could pay off for your portfolio. Choosing between the many different types of bonds may require a plan for your broader investments. A zero coupon bond often requires less money up front than other bonds. Yet zero coupon bonds still carry some of risk and can still be influenced by interest rates. What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%.

How to Find Coupon Rate of a Bond on Financial Calculator Coupon Rate = (Coupon Payment / Par Value) x 100 For example, you have a $1,000 par value bond with an annual coupon payment of $50. The bond has 10 years until maturity. Using the formula above, we would calculate the coupon rate as follows: Coupon Rate = ($50 / $1,000) x 100 = 5% Own or Dealer Bid

Coupon on a bond

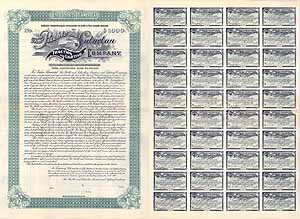

Coupon Definition - Investopedia A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to in terms... What is a Coupon Bond? - Definition | Meaning | Example Definition: A coupon bond is a debt instrument that has detachable slips of paper that can be removed from the bond contract itself and brought to a bank or broker for interest payments. These detachable slips of paper are called coupons and represent the interest payments due to the bondholder. Each coupon has its maturity date printed on it. Coupon Bond - Assignment Point A coupon bond is a debt obligation with coupons attached that reflect semi-annual interest payments, often referred to as a bearer bond or bond coupon. Such detachable paper slips are referred to as coupons and show the interest payments owed to the bondholder. There are no records of the buyer kept by the issuer in the case of coupon bonds; the name of the buyer is also not printed on any ...

Coupon on a bond. Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond.. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.For example, if a bond has a face value of $1,000 and a coupon rate of 5%, then it pays total ... Coupon Bond - Investopedia A coupon bond, also referred to as a bearer bond or bond coupon, is a debt obligation with coupons attached that represent semiannual interest payments. With coupon bonds, there are no records of... Coupon Bond - Definition, Terminologies, Why Invest? The holder of a coupon bond receives a periodic payment of the stipulated fixed interest rate, which is determined by multiplying the coupon rate by the bond's nominal value and the period factor. For example, if you own a bond with a face value of $1,000 and an annual coupon rate of 5%, your annual interest payment will be $5.

Yield to Maturity vs. Coupon Rate: What's the Difference? The coupon rate is the annual income an investor can expect to receive while holding a particular bond. At the time it is purchased, a bond's yield to maturity ... What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities. How the Coupon Interest Rate of a Bond Affects Its Price A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are ... Bond Yield Rate vs. Coupon Rate: What's the Difference? Coupon rates are the yields associated with regular interest payments made by bonds and are influenced by prevailing interest rates. · A bond's yield is the rate ...

Libra Bank pays 6.5% fixed coupon on 10-year bonds denominated in euros ... It is Libra's third bond, with the latest one (of EUR4.3 mln and EUR 500 face value), maturing in 2030, trading on BVB at a yield to maturity of 4.9% resulting from the 5% coupon and a trading ... Zero-Coupon Bond: Formula and Excel Calculator To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks Fixing of coupon rates - Nykredit Realkredit A/S Effective from 29 July 2022, the coupon rates of floating-rate bonds issued by Nykredit Realkredit A/S will be adjusted. Bonds with quarterly interest rate fixing The new coupon rates will apply ... What is a Zero-Coupon Bond? - Robinhood A zero-coupon bond is a type of debt security that provides profit for the investor when it reaches maturity. Unlike traditional bonds, zero-coupon securities don't provide interest payments during the life of the bond. Instead, investors make money on these bonds when they buy them at a deep discount.

Coupon Rate Definition - Investopedia A coupon rate is the yield paid by a fixed income security, which is the annual coupon payments divided by the bond's face or par value.

Zero Coupon Bond | Investor.gov Glossary Zero Coupon Bond Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due.

Coupon Rate Calculator | Bond Coupon A coupon is the interest payment of a bond. Typically, it is distributed annually or semi-annually depending on the bond. We usually calculate it as the product of the coupon rate and the face value of the bond. How often do I receive coupons from investing in bonds? The short answer is it depends on the bonds that you invest in.

What Is Coupon Rate and How Do You Calculate It? What Is Coupon Rate and How Do You Calculate It? Bond coupon rate dictates the interest income a bond will pay annually. We explain how to calculate this rate, and how it affects bond prices. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators

Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000.

Coupon Bond | Definition | Rates | Benefits & Risks | How It Works A coupon bond is an investment that pays a regular interest payment to the holder of the security. The issuer guarantees that it will pay this amount as long as they hold on to the coupon bond. The issuer is also obligated to repay the whole of the bond's face value on its maturity date.

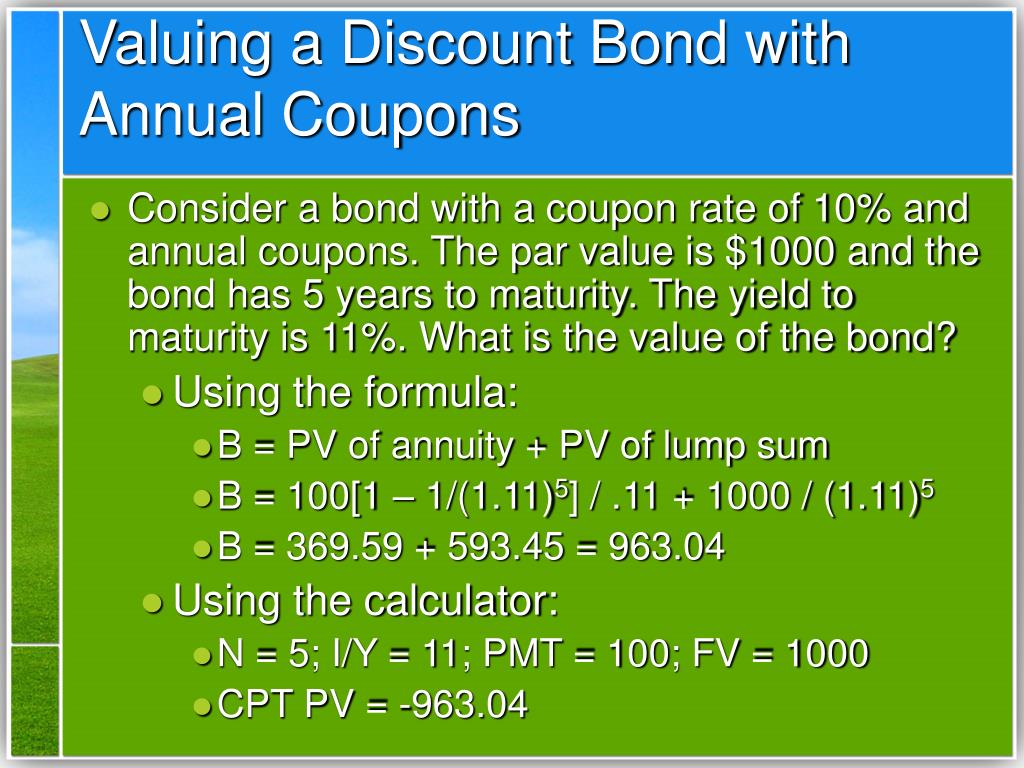

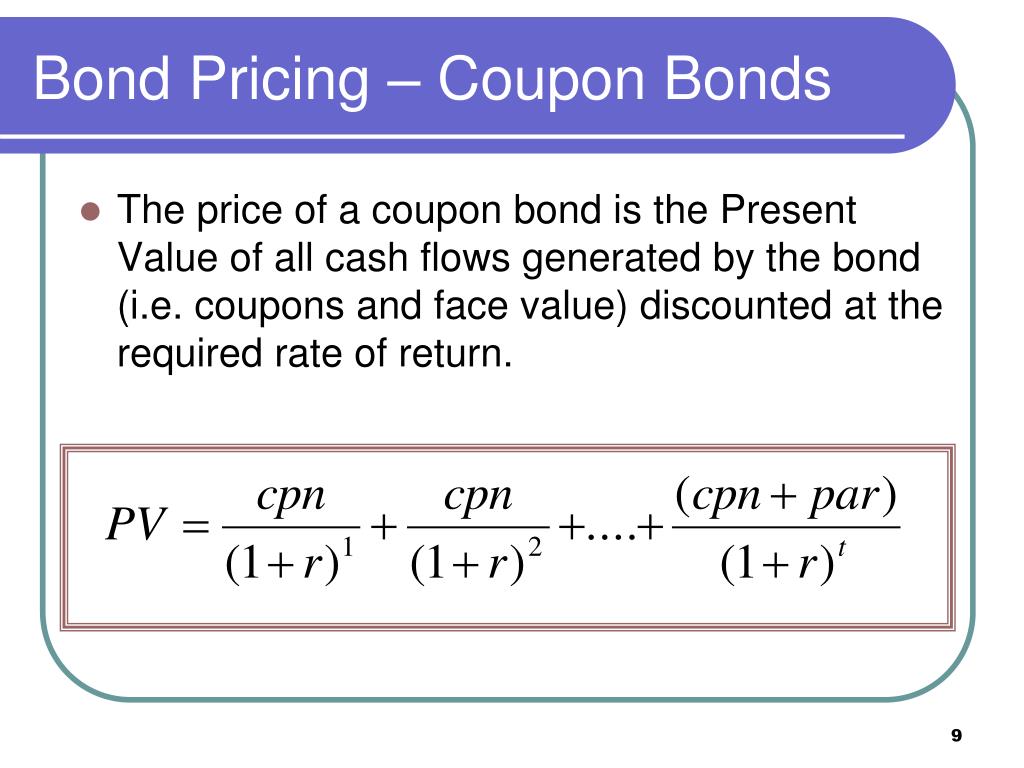

How to Calculate the Price of Coupon Bond? - WallStreetMojo Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates, etc, Please provide us with an attribution link where C = Periodic coupon payment, P = Par value of bond,

Zero-Coupon Bond Definition - Investopedia Regular bonds, which are also called coupon bonds, pay interest over the life of the bond and also repay the principal at maturity. A zero-coupon bond does not pay interest but instead trades at a...

What Is a Zero-Coupon Bond? - The Motley Fool Zero-coupon bonds compensate for not paying any interest over the life of the bond by being available for far less than face value. Put another way, without a deep discount, zero-coupon bonds ...

Zero Coupon Bond -Features, benefits, drawbacks, taxability, & FAQs Coupon bonds pay interest or coupon in predetermined intervals throughout the bond's duration or time to maturity. Zero coupon bonds do not pay any coupon or interest throughout the duration of the bond. Instead, these are sold at a discount to face value and redeemed at face value upon reaching maturity. 7 Best Passive Investment Strategy

Coupon Bond Definition & Example | InvestingAnswers The coupon rate on the bond is 5%, which means the issuer will pay you 5% interest per year, or $50, on the face value of the bond ($1,000 x 0.05). Even if your bond trades for less than $1,000 (or more than $1,000), the issuer is still responsible for paying you $50 per year. To claim your interest payment, you would simply clip off the ...

Zero-Coupon Bond - Definition, How It Works, Formula Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded semi-annually. What price will John pay for the bond today?

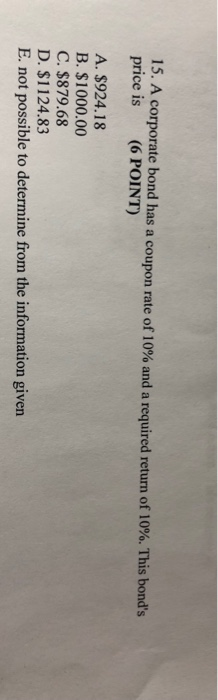

B. What will be the price of a \( 3 \% \) coupon, \( | Chegg.com What will be the price of a 3% coupon, $1,000 face value bond 15 years from today if the bond matures in 25 years and the going rate of interest for such bonds is 6% ? C. What is the value of a $1,000 zero-coupon bond that matures in 25 years when the required rate of return is 4.5% ? D. What is the yield-to-maturity of a $1,000 bond with a ...

Coupon Bond Formula | Examples with Excel Template Coupon Bond is calculated using the Formula given below Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] Coupon Bond = $25 * [1 - (1 + 4.5%/2) -16] + [$1000 / (1 + 4.5%/2) 16 Coupon Bond = $1,033

Coupon Bond - Assignment Point A coupon bond is a debt obligation with coupons attached that reflect semi-annual interest payments, often referred to as a bearer bond or bond coupon. Such detachable paper slips are referred to as coupons and show the interest payments owed to the bondholder. There are no records of the buyer kept by the issuer in the case of coupon bonds; the name of the buyer is also not printed on any ...

What is a Coupon Bond? - Definition | Meaning | Example Definition: A coupon bond is a debt instrument that has detachable slips of paper that can be removed from the bond contract itself and brought to a bank or broker for interest payments. These detachable slips of paper are called coupons and represent the interest payments due to the bondholder. Each coupon has its maturity date printed on it.

Coupon Definition - Investopedia A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to in terms...

Post a Comment for "45 coupon on a bond"