40 formula for coupon rate

Coupon Rate - Meaning, Calculation and Importance - Scripbox The coupon payments are semi-annual, and the semi-annual payments are INR 50 each. To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100. Coupon Rate = 100 / 500 * 100 = 20%. Floating Rate Note (FRN) | Definition, Pricing & Example Where C t is the coupon rate for the period, FV is the face value of the bond, BM t-1 is the benchmark rate (i.e. reference rate) value at the start of the coupon payment period and spread (also called quoted margin, credit margin or default margin) represents a component of the coupon rate set at the time of issue of the bond.

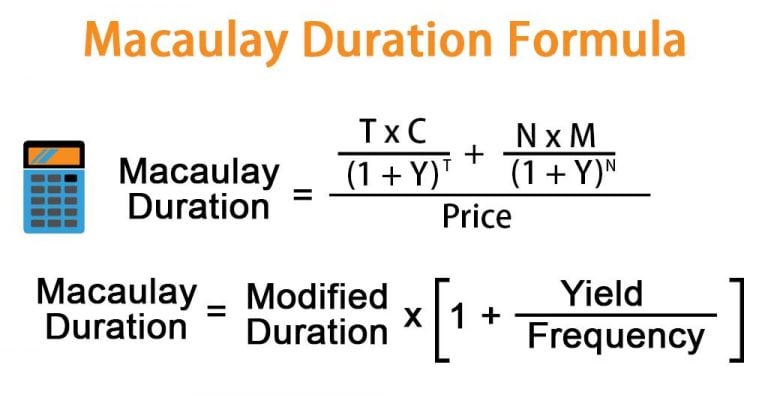

› coupon-rate-formulaCoupon Rate Formula | Step by Step Calculation (with Examples) Formula to Calculate Coupon Rate. Coupon Rate Formula is used for the purpose of calculating the coupon rate of the bond and according to the formula coupon rate of the bond will be calculated by dividing the total amount of annual coupon payments with the par value of the bonds and multiplying the resultant with the 100.

Formula for coupon rate

Calculate the Coupon Rate of a Bond - YouTube This video explains how to calculate the coupon rate of a bond when you are given all of the other terms (price, maturity, par value, and YTM) with the bond ... Coupon Bond Formula | Examples with Excel Template - EDUCBA The formula for coupon bond can be derived by using the following steps: Step 1: Firstly, figure out the par value of the bond being issued and it does not change over the course of its tenure. It is denoted by F. Step 2: Next, figure out the rate of annual coupon and based on that calculate the periodic coupon payment of the bond. The coupon payment is the product of the coupon rate and the par value of the bond. What Is the Coupon Rate of a Bond? - The Balance The formula to calculate a bond's coupon rate is very straightforward, as detailed below. The annual interest paid divided by bond par value equals the coupon rate. As an example, let's say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate.

Formula for coupon rate. › knowledge › apr-annualAnnual Percentage Rate (APR): Formula and Calculator Annual Percentage Rate (APR) Formula. The APR is calculated using the following formula. APR Formula. APR = (Periodic Interest Rate * 365 Days) * 100; Where: Periodic Interest Rate = [(Interest Expense + Total Fees) / Loan Principal] / Number of Days in Loan Term; To express the APR as a percentage, the amount must be multiplied by 100. Coupon Payment | Definition, Formula, Calculator & Example The coupon payment on each of these bonds is $32.5 [=$1,000 × 6.5% ÷ 2]. This means that Walmart Stores Inc. pays $32.5 after each six months to bondholders. Please note that coupon payments are calculated based on the stated interest rate (also called nominal yield) rather than the yield to maturity or the current yield. Zero-Coupon Bond: Formula and Excel Calculator - Wall Street Prep If we input the provided figures into the present value (PV) formula, we get the following: Present Value (PV) = $1,000 / (1 + 3.0% / 2) ^ (10 * 2) PV = $742.47. The price of this zero-coupon is $742.47, which is the estimated maximum amount that you can pay for the bond and still meet your required rate of return. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Formula for Calculating the Coupon Rate Where: C = Coupon rate i = Annualized interest P = Par value, or principal amount, of the bond Download the Free Template Enter your name and email in the form below and download the free template now! How the Coupon Rate Affects the Price of a Bond All types of bonds pay interest to the bondholder.

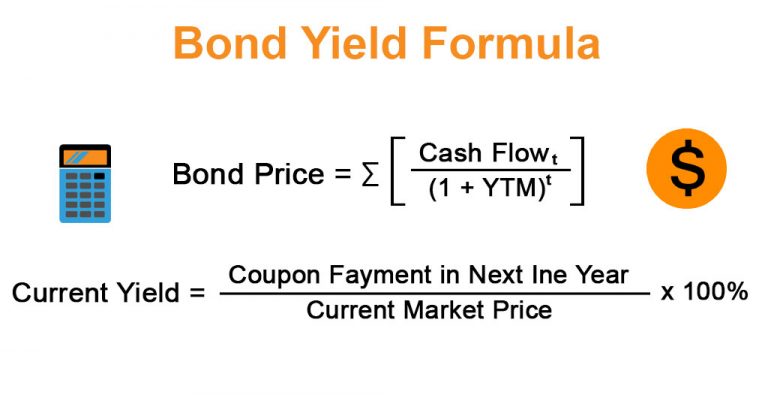

Yield to Maturity (YTM) - Overview, Formula, and Importance On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. For example, if a... What Is a Coupon Rate? - Investment Firms Let's take a look at the formula for calculating the coupon rate and how we can apply them. Simple Formula C = I/P Where: C = coupon rate I = annualized interest P = par value The coupon rate is the rate by which the bond issuer pays the bondholder. What Is Coupon Rate and How Do You Calculate It? - SmartAsset Every six months it pays the holder $50. To calculate the bond coupon rate we add the total annual payments then divide that by the bond's par value: ($50 + $50) = $100. $100 / $1,000 = 0.10. The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year.

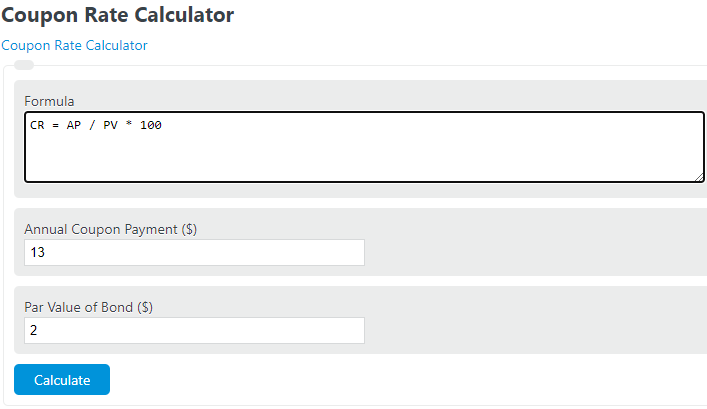

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. Coupon Rate: Formula and Bond Nominal Yield Calculator - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000 Coupon Rate Calculator | Bond Coupon You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value. For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time! › annualized-rate-of-return-formulaAnnualized Rate of Return Formula | Calculator | Example ... The bond paid coupon at the rate of 6% per annum for the next 10 years until its maturity on December 31, 2014. Calculate the annualized rate of return earned by the investor from the bond investment.

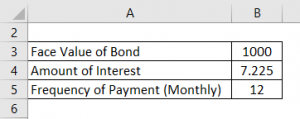

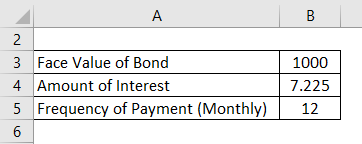

Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator This calculator calculates the coupon rate using face value, coupon payment values.

› discount-rate-formulaDiscount Rate Formula | How to calculate Discount Rate with ... Discount Rate = ($3,000 / $2,200) 1/5 – 1 Discount Rate = 6.40% Therefore, in this case the discount rate used for present value computation is 6.40%. Discount Rate Formula – Example #2

Coupon Rate: Definition, Formula & Calculation - Study.com Coupon Rate Formula. The formula for coupon rate is as follows: C = i / p . where: C = coupon rate ; i = annualized interest (or coupon) p = par value of bond ; Coupon Rate Calculation Example

corporatefinanceinstitute.com › rate-functionRATE Function - Formula, Examples, How to Use RATE Function Jun 07, 2022 · For a financial analyst, the RATE function can be useful to calculate the interest rate on zero coupon bonds. Formula =RATE(nper, pmt, pv, [fv], [type], [guess]) The RATE function uses the following arguments: Nper (required argument) – The total number of periods (months, quarters, years, etc.) over which the loan or investment is to be paid.

Formula for: Zero-coupon rate from the discount factor - iotafinance.com Formula for the calculation of the zero-coupon interest rate for a given maturity from the discount factor Formula \[ r_{zero,n}=\left( \frac{1}{ PVf_{n}} \right)^{\frac{1}{n}} \ \]

How to Calculate a Coupon Payment | Sapling Twice-yearly equal coupon payments. If your security's par value is $1,000, and you receive two coupon payments of $25 each, your annual payment is $50 ($25 x 2 payments each year). Your coupon rate is 5 percent: $50 (total annual coupon payment) divided by $1,000 (par value) x 100 percent. Unequal periodic payments.

› coupon-rate-bondCoupon Rate of a Bond (Formula, Definition) | Calculate ... Finally, the formula of the coupon rate of the bond is calculated by dividing the annualized interest payments by the par value of the bond and multiplied by 100%, as shown below. Examples Let us take the example of a bond with quarterly coupon payments.

What is 'Coupon Rate' - The Economic Times Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 bond with a coupon rate of 10 ...

Zero Coupon Bond Yield - Formula (with Calculator) - finance formulas The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as This formula will then become By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100. Coupon ...

Coupon Rate Formula | Simple-Accounting.org A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value.As a simple example, consider a zero coupon bond with a face, or par, value of $1200, and a maturity of one year.

How to Calculate a Coupon Payment: 7 Steps (with Pictures) - wikiHow 1. Use the coupon rate and the face value to calculate the annual payment. If you know the face value of the bond and its coupon rate, you can calculate the annual coupon payment by multiplying the coupon rate times the bond's face value. For example, if the coupon rate is 8% and the bond's face value is $1,000, then the annual coupon payment ...

› effective-tax-rate-formulaEffective Tax Rate Formula | Calculator (Excel Template) - EDUCBA For 2018. Effective Tax Rate = 10.6% For 2017. Effective Tax Rate = 20.2% Explanation. Because of the progressive tax system, all the income will not be taxed at the same rate.

Coupon Bond Formula | How to Calculate the Price of Coupon Bond? It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more. Example #2. Let us take an example of bonds issued by company ABC Ltd that pays semi-annual coupons. Each bond has a par value of $1,000 with a coupon rate of 8%, and it is to mature in 5 years. The effective yield to maturity is 7%.

Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000...

Post a Comment for "40 formula for coupon rate"