41 a general co bond has an 8% coupon

Solved A General Co. bond has an 8% coupon and pays interest - Chegg A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 20 years. What is the yield to maturity? Expert Answer 92% (12 ratings) Yield to Maturity is the internal rate of return of the Bond. It represents the amount of profit or loss on the … CRED ASX ETF | Investment Grade Bond ETF | BetaShares BetaShares Australian Investment Grade Corporate Bond ETF Opportunity to earn attractive regular income, paid ... PACIFIC NATIONAL FINANCE PTY LTD 3.8% SEP-31: 2.3: QPH FINANCE CO PTY LTD 2.85% JAN-31: 2.2: ... GENERAL PROPERTY TRUST 2.849% FEB-32

Answered: Bond J has a coupon rate of 5.1… | bartleby Q: A General Power bond carries a coupon rate of 8.5%, has 9 years until maturity, and sells at a yield… A: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question and…

A general co bond has an 8% coupon

Finance Chapter 5 Flashcards | Quizlet As a general rule, which of the following are true of debt and equity? ... What is the coupon rate on a bond that has a par value of $1000, a market value of $1,100, and a coupon interest payment of $100 per year. 10%. ... ABC Co. issued 1 million 6 percent annual coupon bonds that mature in 10 years. The face value is $1,000 per bond. What are ... Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields ... Coupon Rate Calculator | Bond Coupon As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ...

A general co bond has an 8% coupon. A general co bond has an 8 coupon and pays interest - Course Hero A corporate bond with a face value of $ 1,000 matures in 4 years and has an 8 % coupon paid at the end of each year . The current price of the bond is $ 932 . The current price of the bond is $ 932 . Answered: A 10-year corporate bond has a coupon… | bartleby Q: A bond has a coupon payment of $22 every 6-months. It is trading at 98.6, is rated BBB, and has 8… A: Bonds are the liabilities of the company which is issued to raise the funds required to finance the… A General Co. bond has an 8% coupon and pays interest annually. The ... A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 20 years. What is the yield to maturity?... List of Bonds in India | Best Investment Options | Bond Directory ... However, if the annual coupon payment is divided by the bond's current market price, the investor can calculate the current yield of the bond. Current yield is simply the current return an investor would expect if he/she held that investment for one year, and this yield is calculated by dividing the annual income of the investment by the investment’s current market price.

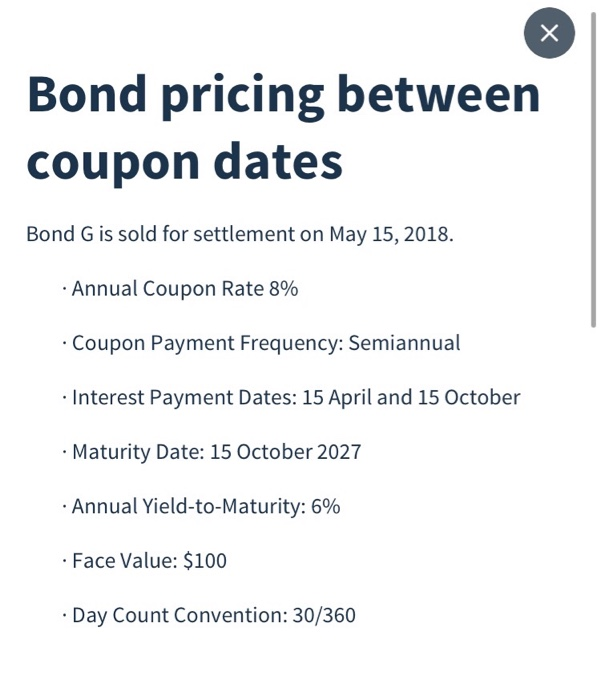

Solved A General Co. bond has an 8% coupon and pays | Chegg.com A General Co. bond has an 8% coupon and pays interest semiannually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 7 years. Government Bonds: UK Gilts Explained | CMC Markets 25-04-2020 · Government bonds in the UK are now being released with an 8% coupon. As your coupon is only 5%, demand falls for your bond, reducing its value to £95. If interest rates fall… the cost of borrowing reduces. Government bonds in the UK are now being issued with a 3% coupon. Our 5% coupon is now worth more than the new coupons. Answered: A bond has a $14,000 face value, a… | bartleby Q: If the General Electric bonds you purchased had paid you a total of $8,680 at maturity, how much did… A: Click to see the answer Q: A bond with a face value of $4000 and a 3.8% coupon has a 5-year maturity. Coupon Rate of a Bond - WallStreetMojo Let us take the example of a bond with quarterly coupon payments. Let us assume a company XYZ Ltd has issued a bond having a face value of $1,000 and quarterly interest payments of $15. If the prevailing market rate of interest is 7%, then the bond will be traded at _____

Finance exam 2 Flashcards | Quizlet ABC Co. issued 1 million 6 percent annual coupon bonds that mature in 10 years. ... What are the cash flows involved in the purchase of a 5-year zero-coupon bond that has a par value of $1,000 if the current price is $800? ... In general, the price that is paid for a bond will exceed its quoted price. True false question. True False. What is the price of a two year bond with a 9% annual coupon and a ... What is the price of a two year bond with a 9% annual coupon and a yield to maturity of 8%? - 52405911. ... Secondary School answered • expert verified What is the price of a two year bond with a 9% annual coupon and a yield to maturity of 8%? ... (Hons.) '14- Adapted) depreciation in 1:3 ratio between the departments A and B. General ... Coupon Bond - Investopedia Coupon Bond: A coupon bond, also referred to as a bearer bond, is a debt obligation with coupons attached that represent semi-annual interest payments. With coupon bonds, there are no records of ... Bond Definition - Investopedia 01-07-2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ...

Convertible Bond Definition - Investopedia 06-10-2020 · Convertible Bond: A convertible bond is a type of debt security that can be converted into a predetermined amount of the underlying company's equity at certain times during the bond's life ...

Chapter 7 Flashcards | Quizlet Heymann Company bonds have 4 years left to maturity. Interest is paid annually, and the bonds have a $1,000 par value and a coupon rate of 9%. ... Last year Clark Company issued a 10-year, 12% semiannual coupon bond at its par value of $1,000. Currently, the bond can be called in 4 years at a price of $1,060 and it sells for $1,100. a. What are ...

Solved A General Co. bond has an 8% coupon and pays interest - Chegg A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 20 years. What is the yield to maturity? 7.82% 8.12% 8.04% 7.79% 8.00%.

Answered: Assume that a company issued a bond… | bartleby Q: A firm's bonds have a maturity of 12 years with a $1,000 face value, have an 8% semi-annual coupon,… Q: What is the current price of a 4-year bond that has a face value of £100, a yield to maturity of 10%…

1. A General Co. bond has an 8% coupon and pays interest annually. The ... 03/20/2020. Business. College. answered • expert verified. 1. A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 10 years.

Reserve Bank of India - Frequently Asked Questions The current yield for a 10 year 8.24% coupon bond selling for ₹103.00 per ₹100 par value is calculated below: Annual coupon interest = 8.24% x ₹100 = ₹8.24. Current yield = (8.24/103) X 100 = 8.00%. The current yield considers only the coupon interest and ignores other sources of return that will affect an investor’s return.

8 a general co bond has an 8 coupon and pays interest A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 20 years.

Vanilla Ice Co bonds pay an annual coupon rate of 10 and have 12 years ... 4. General Electric 30-year bonds have a 7.5% annual coupon rate and a par value of their bonds be? FV=10,000 N=30 PMT=750 I/Y=6.25%. 5. Austin Power Co. bonds have a 14% annual coupon rate. Interest is paid semi-annually. The bonds have a par value of $1,000 and will mature 10 years from now. If the ...

FIN780 Chapter 5.docx - A bond with a 7% coupon that pays... A General Co. bond has an 8% coupon and pays interest annually. The face value is $1000 and the current market price is $1,020.50. The bond matures in 20 years. What is the yield to maturity? N = 20 PV = -1,020.50PMT = (1,000x8%) FV = 1,000 CPT I/Y = 7.79% A General Co. bond has an 8 % coupon and pays interest annually .

A General Co. bond has an 8% coupon and pays interest semiannually. The ... A General Co. bond has an 8% coupon and pays interest semiannually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 7 years. What is the yield to maturity?...

Answered: Bond valuation) A bond that matures in… | bartleby Solution for Bond valuation) A bond that matures in 15years has a $1,000 par value. ... A three-month forward contract exists on a zero-coupon corporate bond with a current price per £100 ... Sun Co., an electronics product manufacturer, ...

FIN 3000 HW 6 Flashcards | Quizlet A General Power bond with $1000 par value carries a coupon rate of 8%, has 9 years until maturity, and sells at a yield to maturity of 7%. ... Sure Tea Co. has issued 9% annual coupon bonds of which face value is $1000 that are now selling at a yield to maturity of 10% and current yield of 9.8375%. What is the remaining maturity of these bonds?

CF Chp 8 Flashcards | Quizlet American Fortunes is preparing a bond offering with an 8% coupon rate. The bonds will be repaid in 10 years. The company plans to issue the bonds at par value and pay interest semiannually. Given this, which of the following statements are correct? I. The initial selling price of each bond will be $1,000. II.

Post a Comment for "41 a general co bond has an 8% coupon"