42 coupon rate and ytm

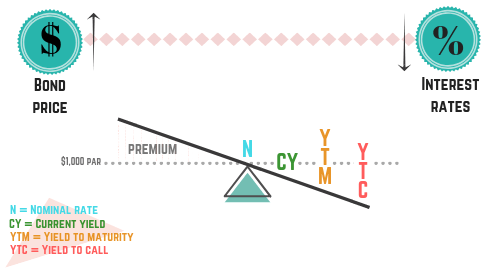

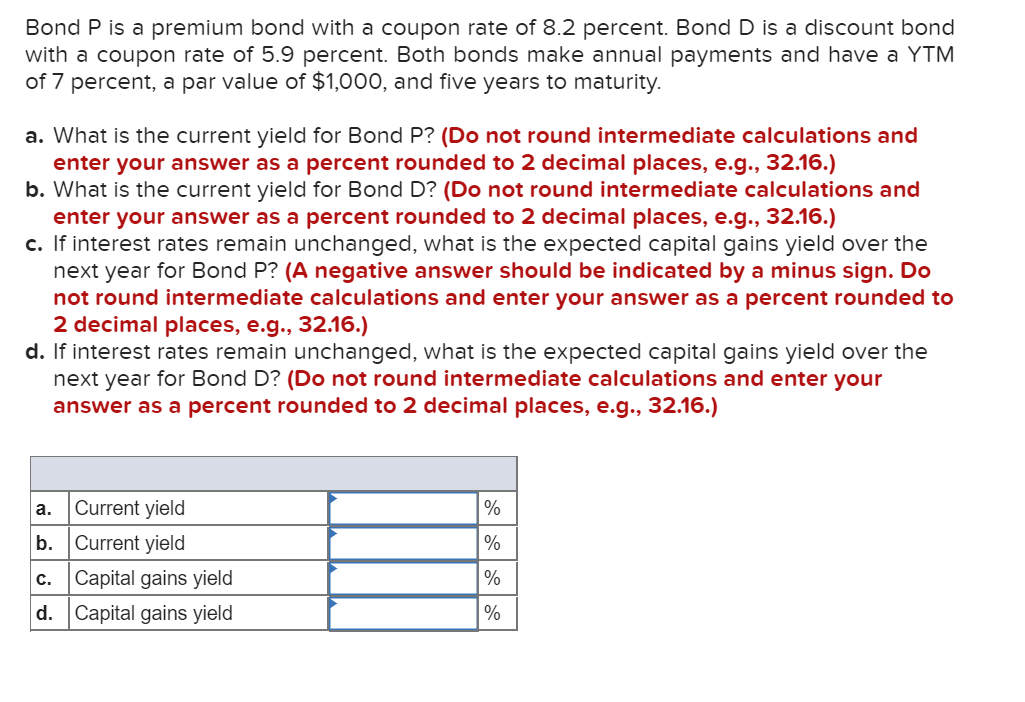

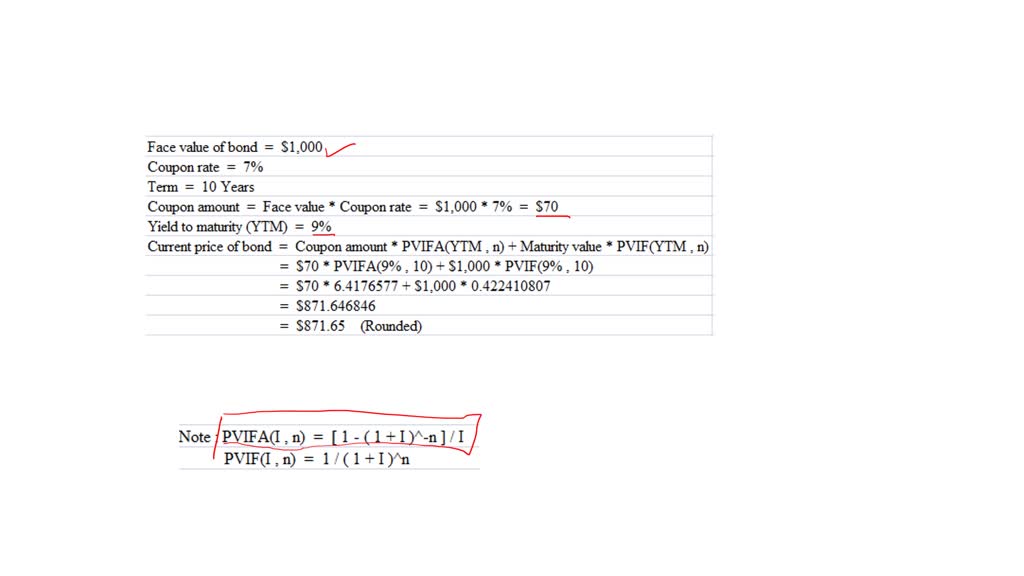

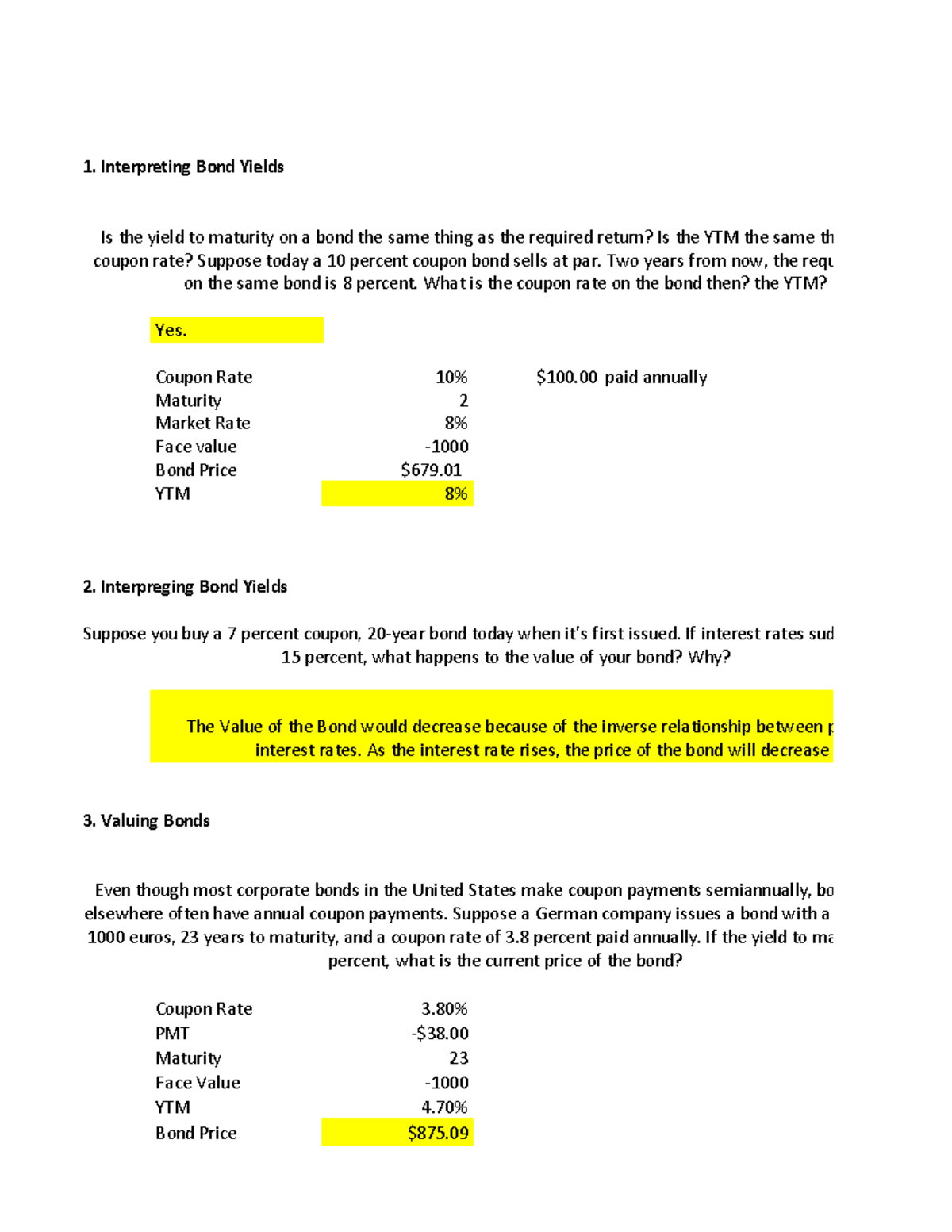

Solved Describe the impact of the coupon rate and yield to - Chegg Finance questions and answers. Describe the impact of the coupon rate and yield to maturity (YTM) on the bond par value and market value. If the Federal Reserve Bank decides to increase the interest rate by 1% beginning next quarter, what steps would you take as the CFO of a company to raise capital from the financial markets? Bond Pricing Formula | How to Calculate Bond Price? | Examples The prevailing market rate of interest is 7%. Hence, the price of the bond calculation using the above formula as, Bond price = $104,158.30 Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium Example #3 Let us take the example of a zero-coupon bond.

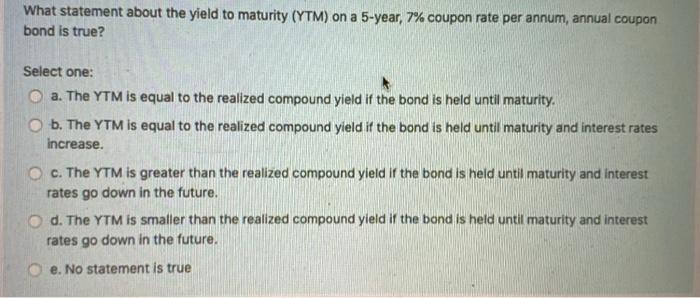

› terms › yYield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

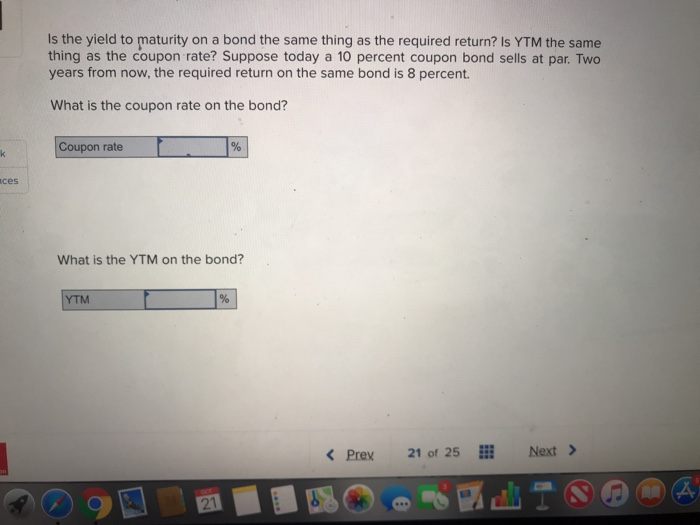

Coupon rate and ytm

What relationship between a bond's coupon rate and a bond's yield would ... If yield is higher than the coupon rate then the bond is trading at a discount. Let's say you own a bond that you paid $1,000 for and it has a coupon rate of 10%. That means that this Bond will pay $100 per year in interest no matter what its price on the market. Therefore , your yield is also 10%. Par rate, coupon rate and YTM : CFA - reddit.com The par rate is: the COUPON RATE that makes that a bond will sell at par GIVEN interest rates (that is, given by the markt), or. the YTM that makes that a bond will sell at par GIVEN coupon rate (that is, the coupon that decides the goverment). I know that it sound stupid and I'm 99,999% sure that the option correct is 1). What's the difference b/w coupon rate and YTM? And why do we ... - reddit If the current price of the bond is equal to the par value, the only thing we get is the coupon payment, so YTM = coupon rate. If the price is lower than par value, YTM > coupon rate because we get some capital gain (price return) as well, and vice versa if the current trading price is above par.

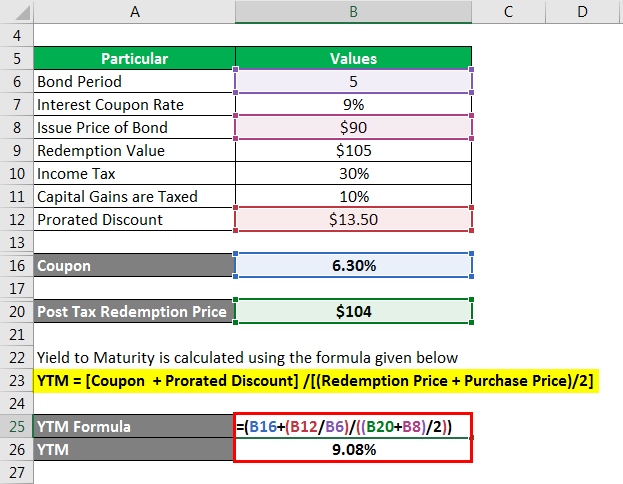

Coupon rate and ytm. Coupon Rate - Meaning, Calculation and Importance - Scripbox The main distinction between the coupon rate and YTM is the return estimation. The coupon rate payments are the same for the bond tenure. While the yield on maturity varies depending on various factors such as the number of years till maturity and the current trading price of the bond. Let's assume the couponrate for a bond is 15%. Yield to Maturity (YTM): Formula and Calculator (Step-by-Step) An important distinction between a bond's YTM and its coupon rate is the YTM fluctuates over time based on the prevailing interest rate environment, whereas the coupon rate is fixed. The relationship between the yield to maturity and coupon rate (and current yield) are as follows. Coupon Rate Definition - Investopedia 28. Mai 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... How To Calculate YTM (Years To Maturity) On A Financial Calculator YTM = [ (Face Value - Market Price) / Market Price] * [1 / Years to Maturity] - 1 + [Coupon Rate / 2] For example, let's say that Johnnie's bond has a face value of $1,000, a market price of $950, a coupon rate of 5%, and 20 years until maturity. Plugging those numbers into the equation above would give us a YTM of 4.76%.

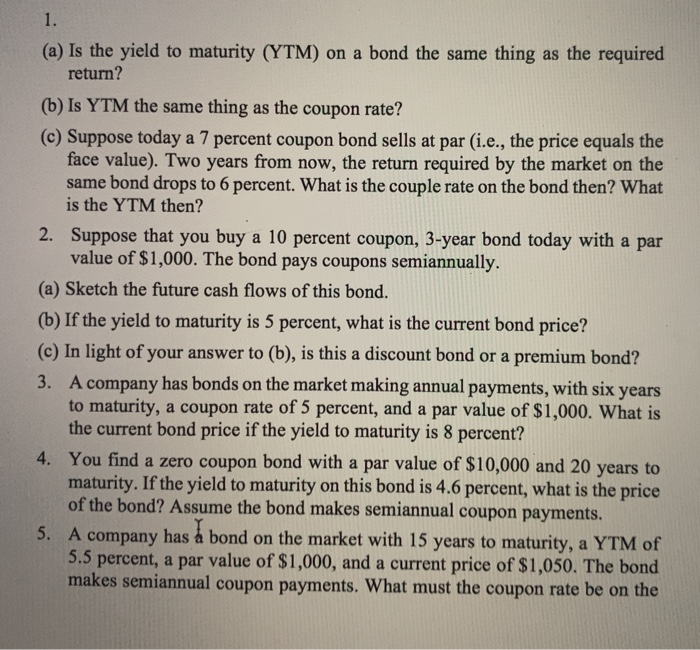

Calculate the Coupon Rate of a Bond - YouTube This video explains how to calculate the coupon rate of a bond when you are given all of the other terms (price, maturity, par value, and YTM) with the bond ... Difference Between YTM and Coupon rates Nevertheless, the term 'coupon' is still used, even though the physical object is no longer implemented. Summary: 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2. › ask › answersMacaulay Duration vs. Modified Duration: What's the Difference? Sep 19, 2022 · For example, consider a three-year bond with a maturity value of $1,000 and a coupon rate of 6% paid semi-annually. The bond pays the coupon twice a year and pays the principal on the final payment. › financial-literacy › basics-ofBasics Of Bonds - Maturity, Coupons And Yield Sep 19, 2022 · The coupon is always tied to a bond’s face or par value and is quoted as a percentage of par. Say you invest $5,000 in a six-year bond paying a coupon rate of five percent per year, semi-annually. Assuming you hold the bond to maturity, you will receive 12 coupon payments of $125 each, or a total of $1,500.

What are interest rates, coupon rates, yield and YTM - Times Now New bonds will also be issued at lower coupon rates. ... Yield to Maturity. In the above example, when the buyer of your bond (let's name her Charu ) buys it, she looks at a concept called 'Yield to Maturity' (YTM). YTM is the total return anticipated on a bond if the bond is held until it matures. The face value of the bond, in our ... Yield to Maturity - YTM vs. Spot Rate. What's the Difference? The spot interest rate for a zero-coupon bond is the same as the YTM for a zero-coupon bond. Yield to Maturity (YTM) Investors will consider the yield to maturity as they compare one... Coupon Bond | Coupon Bond Price | Examples of Coupon Bond - EDUCBA Yield to maturity, YTM = 7%; Since the coupon is paid semi-annually, Coupon, C = $1,000 * 8% / 2 = $40; Number of periods until maturity, n = 6 * 2 = 12; Now, the price of the CB can be calculated by using the above formula as, ... If the coupon rate is less than the yield to maturity, then market value of the bond is less than the par value ... Coupon Rate Formula | Step by Step Calculation (with Examples) Harry said that the coupon rate is 10.53% Annual Coupon Payment Annual coupon payment = 4 * Quarterly coupon payment = 4 * $25 = $100 Therefore, the coupon rate of the bond can be calculated using the above formula as, Coupon Rate of the Bond will be - Therefore, Dave is correct.

Yield to Maturity (YTM) - Overview, Formula, and Importance Yield to Maturity (YTM) - otherwise referred to as redemption or book yield - is the speculative rate of return or interest rate of a fixed-rate security. ... On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like ...

Yield to Maturity vs Coupon Rate - Speck & Company Yield to Maturity (YTM) is the expected rate of return on a bond or fixed-rate security that is bought by an investor and held to maturity. Coupon rate is a fixed value in relation to the face value of a bond. If yield to maturity is greater than the coupon rate, the bond is trading at a discount to its par value.

What Is a Coupon Rate? - Investment Firms The difference between a yield to maturity and a coupon rate is: The YTM has an estimated rate of return which the buyer holds till its maturity date. When that happens, one can reinvest their profits with the same interest rate as before. The coupon rate is included in the YTM formula.

Understanding Coupon Rate and Yield to Maturity of Bonds Let's see what happens to your bond when interest rates in the market move. When bonds are initially issued in the primary market, the Coupon Rate is based on current market rates, hence YTM is equal to the Coupon Rate. In the example bond above, when you bought the 3-year RTB issued at the primary market, your YTM and Coupon Rate is 2.375%.

investinganswers.com › dictionary › yYield to Maturity (YTM) Definition & Example | InvestingAnswers Mar 10, 2021 · The bond will mature in 6 years and the coupon rate is 5%. To determine the YTM, we’ll use the formula mentioned above: YTM = t√$1,500/$1,000 - 1. The estimated YTM for this bond is 13.220%. How Yield to Maturity Is Calculated (for Zero Coupon Bonds) Since zero coupon bonds don’t have recurring interest payments, they don’t have a ...

Coupon Rate To Ytm - bizimkonak.com Understanding Coupon Rate and Yield to Maturity of Bonds. CODES (1 days ago) Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: Security Name. Coupon Rate. Maturity Date. RTB 03-11. 2.375%. 3/9/2024. The … Visit URL

Bond Price Calculator Coupon rate is the annual rate of return the bond generates expressed as a percentage from the bond's par value. Coupon rate compounding frequency that can be Annually, Semi-annually, Quarterly si Monthly. Market interest rate represents the return rate similar bonds sold on the market can generate.

Coupon Rate Formula & Calculation - Study.com Generally, the market interest rate and the coupon rate are the same when the bond is first issued. The coupon rate is also different from the yield to maturity (YTM). The yield to maturity ...

dqydj.com › bond-yield-to-call-calculatorBond Yield to Call (YTC) Calculator - DQYDJ Coupon Payment Frequency - How often the bond makes coupon payments. Bond YTC Calculator Outputs. Yield to Call (%): The converged upon solution for the yield to call of the current bond (the internal rate of return assuming the bond is called). Current Yield (%): The simple calculated yield which uses the current trading price and face value ...

home.treasury.gov › interest-rate-statisticsInterest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data

Difference Between Coupon Rate and Yield to Maturity The main difference between Coupon Rate and Yield to Maturity (YTM) is that Coupon Rate is the fixed sum of money that a person has to pay at face value. In contrast, Yield to Maturity (YTM) is the amount a person will retrieve after the maturation of their bonds. The Coupon Rate is said to be the same throughout the bond tenure year.

Yield to maturity - Wikipedia If a bond's coupon rate is more than its YTM, then the bond is selling at a premium. If a bond's coupon rate is equal to its YTM, then the bond is selling at par. Variants of yield to maturity [ edit] As some bonds have different characteristics, there are some variants of YTM:

› terms › bBond Valuation: Calculation, Definition, Formula, and Example May 31, 2022 · Bond valuation is a technique for determining the theoretical fair value of a particular bond. Bond valuation includes calculating the present value of the bond's future interest payments, also ...

Coupon Rate and Yield to Maturity | How to Calculate Coupon Rate 34 Dislike Share Save Corporate Finance Institute 240K subscribers The coupon rate represents the actual amount of interest earned by the bondholder annually while the yield to maturity is...

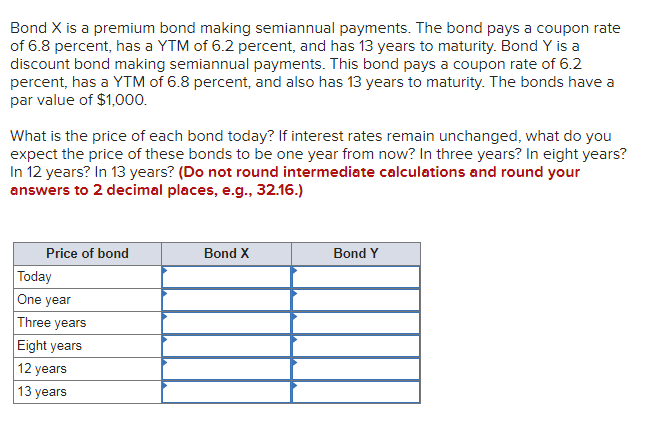

Concept 82: Relationships among a Bond's Price, Coupon Rate ... - Donuts The relationship between a bond's price and its YTM is convex. Percentage price change is more when discount rate goes down than when it goes up by the same amount. Relationship with coupon rate A bond is priced at a premium above par value when the coupon rate is greater than the market discount rate.

Difference between YTM and Coupon Rates A YTM, or yield-to-maturity, reflects the annual return an investor would receive if they held a bond until it matures. A coupon rate is the percentage of the face value of a bond that is paid out as interest to investors on a yearly basis. The higher the coupon rate, the more money investors will earn on their investment.

Yield to Maturity vs Coupon Rate: What's the Difference The YTM considers market changes because, even though your bond's interest rate will not change, its value will fluctuate depending on the market's rates. You need to know the coupon rate, the price of the bond, its value, and the maturity date to calculate the YTM. If you purchase the bond at face value, the YTM and the coupon rate are the ...

What's the difference b/w coupon rate and YTM? And why do we ... - reddit If the current price of the bond is equal to the par value, the only thing we get is the coupon payment, so YTM = coupon rate. If the price is lower than par value, YTM > coupon rate because we get some capital gain (price return) as well, and vice versa if the current trading price is above par.

Par rate, coupon rate and YTM : CFA - reddit.com The par rate is: the COUPON RATE that makes that a bond will sell at par GIVEN interest rates (that is, given by the markt), or. the YTM that makes that a bond will sell at par GIVEN coupon rate (that is, the coupon that decides the goverment). I know that it sound stupid and I'm 99,999% sure that the option correct is 1).

What relationship between a bond's coupon rate and a bond's yield would ... If yield is higher than the coupon rate then the bond is trading at a discount. Let's say you own a bond that you paid $1,000 for and it has a coupon rate of 10%. That means that this Bond will pay $100 per year in interest no matter what its price on the market. Therefore , your yield is also 10%.

Post a Comment for "42 coupon rate and ytm"