44 coupon rate and market rate

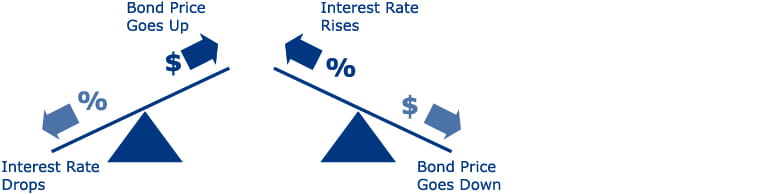

Bond Coupon Interest Rate: How It Affects Price - Investopedia When the prevailing market rate of interest is higher than the coupon rate—say there's a 7% interest rate and a bond coupon rate of just 5%—the price of the bond tends to drop on the open market... The Difference between a Coupon and Market Rate - BrainMass Coupon rate is the interest rate to be paid on the bond at regular interval. In this case coupon rate is 8%. If the face value of the bond is $1000, the holder of the bond will receive $80 at the end of every year during the duration of the bond. In addition the bond holder will receive $1000 back on the maturity of the ... Solution Summary

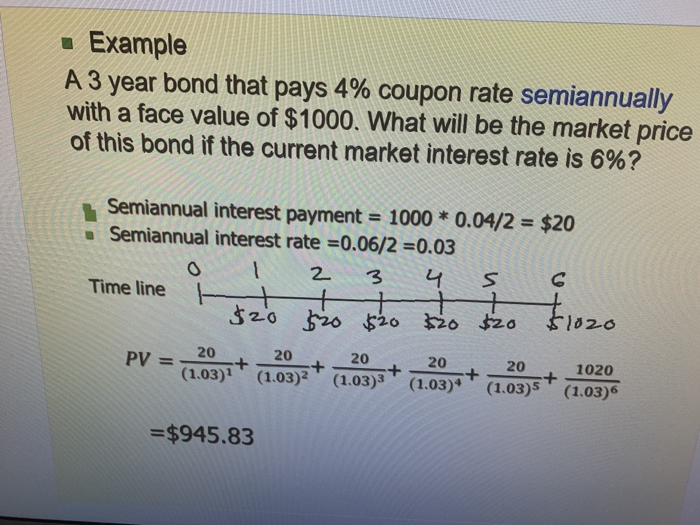

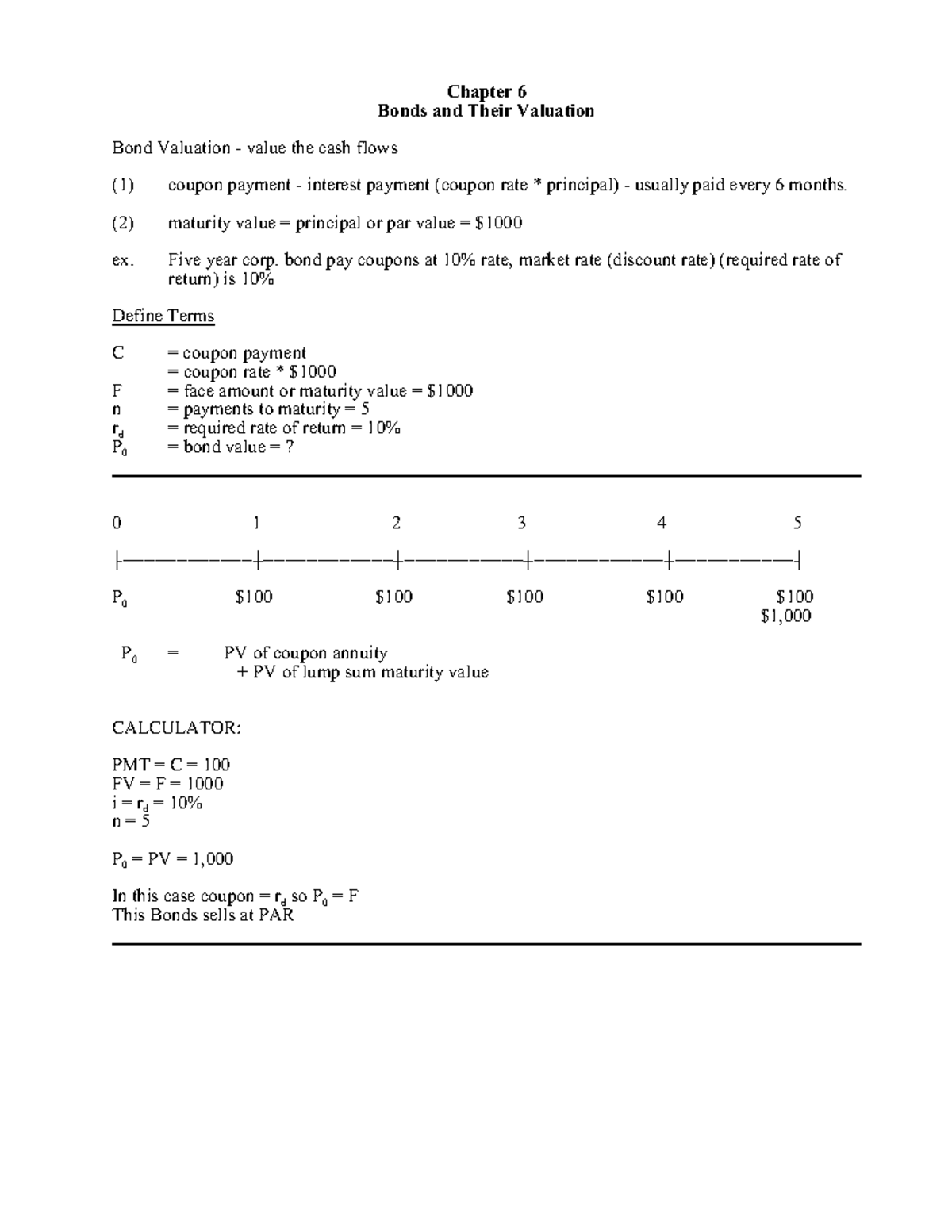

Par Bond - Overview, Bond Pricing Formula, Example Example 3: Par Bond. Consider a bond with a 5-year maturity and a coupon rate of 5%. The market interest rate is 5%. For the bond above, the coupon rate is equal to the market interest rate. In such a scenario, a rational investor would only be willing to purchase the bond at par to its face value because its coupon return is the same as the ...

Coupon rate and market rate

What is a Coupon Rate? - Definition | Meaning | Example In order to calculate the coupon rate formula of a bond, we need to know: the face value of the bond, the annual coupon rate, and the number of periods per annum. Let's look at an example. Example. The coupon payment on each bond is $1,000 x 8% = $80. So, Georgia will receive $80 interest payment as a bondholder. Coupon Rate - Meaning, Calculation and Importance - Scripbox To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds Bonds pay interest to their holders. Coupon Rate Formula & Calculation - Study.com Examples of How to Calculate Coupon Rate. Company ABZ is raising capital for its new project by issuing bonds in the capital market. The company is issuing 20,000 bonds at $1,000 par value that ...

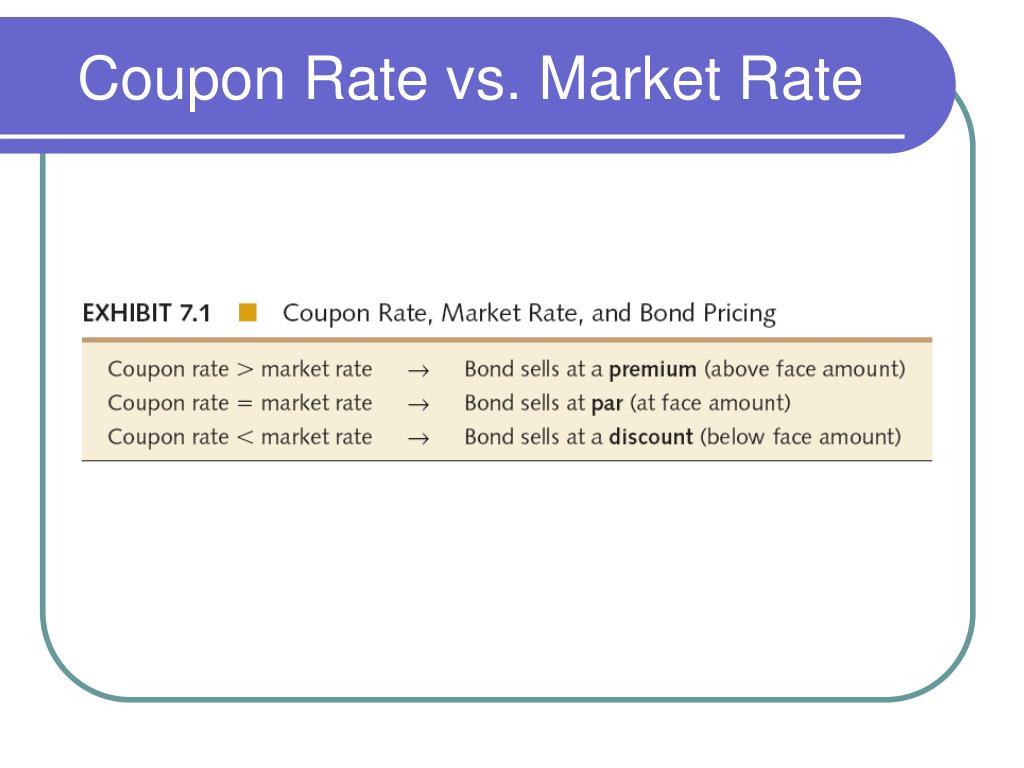

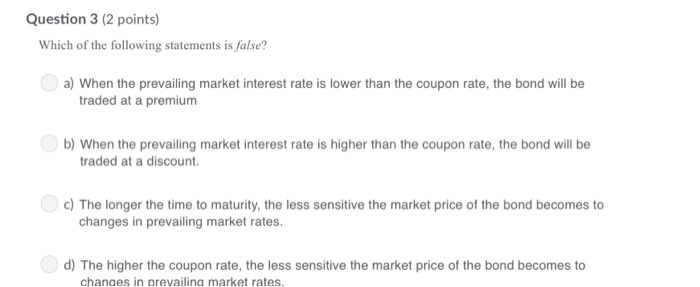

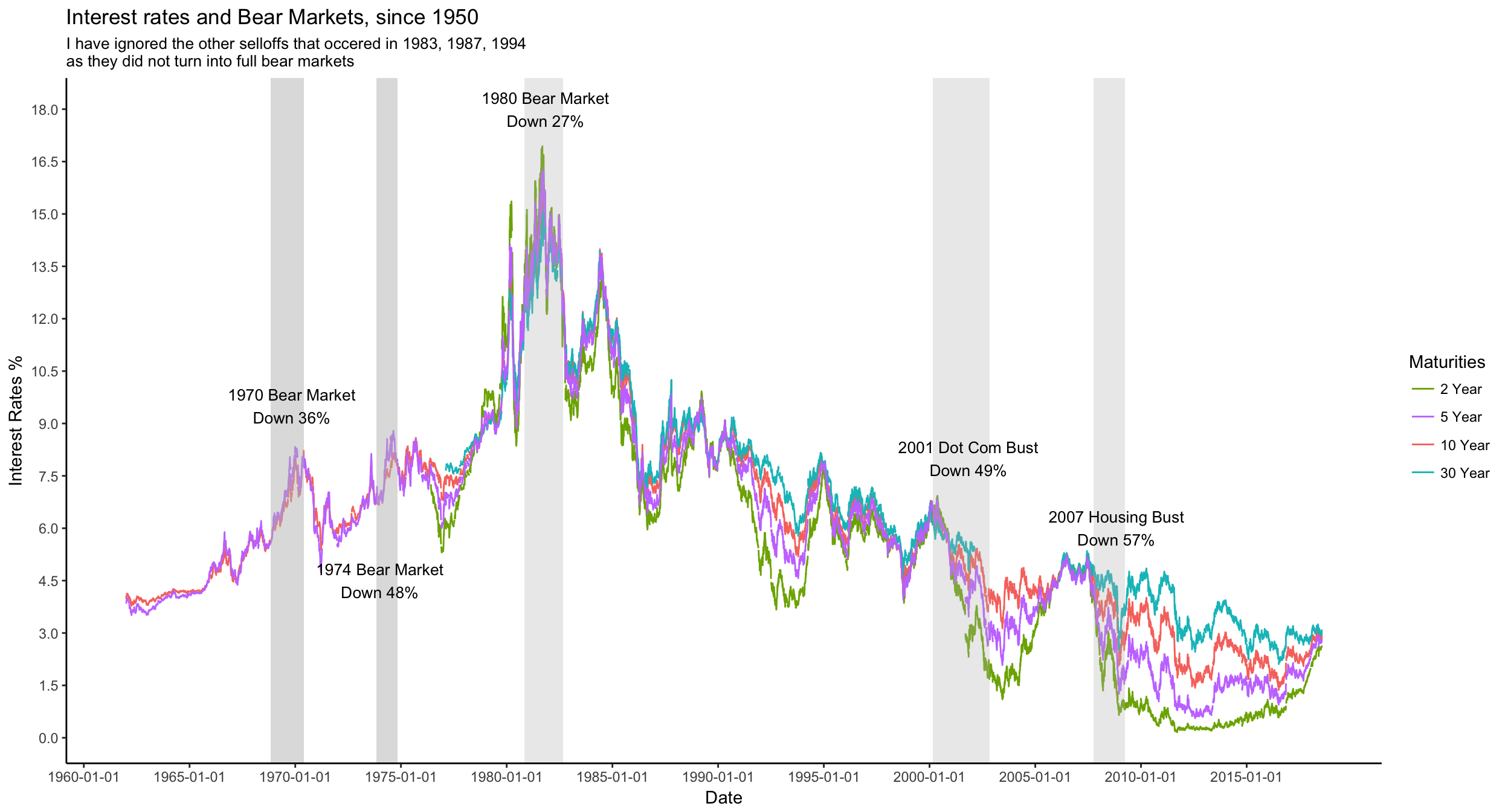

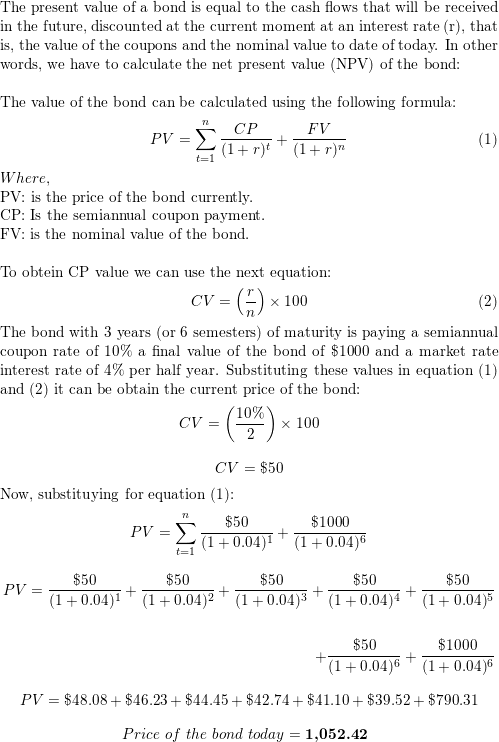

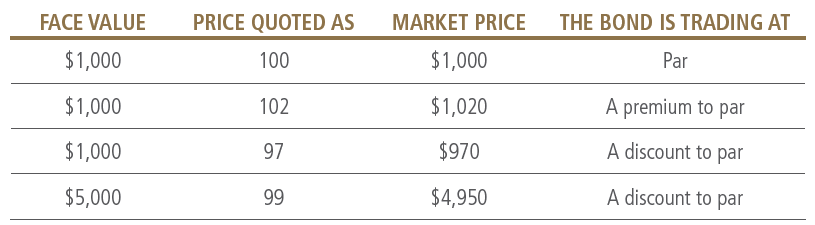

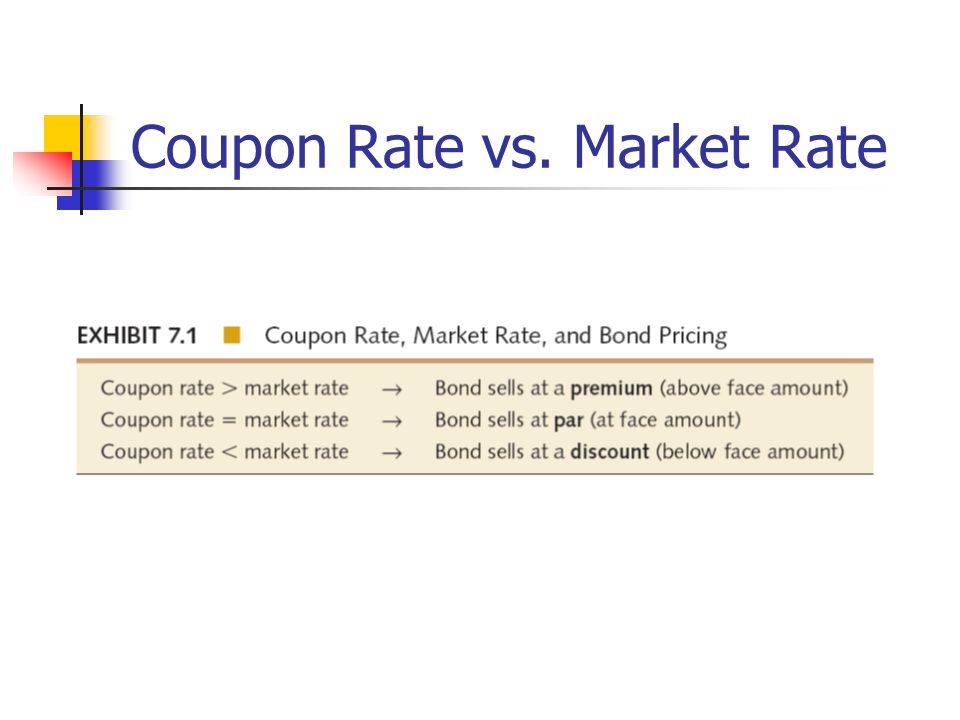

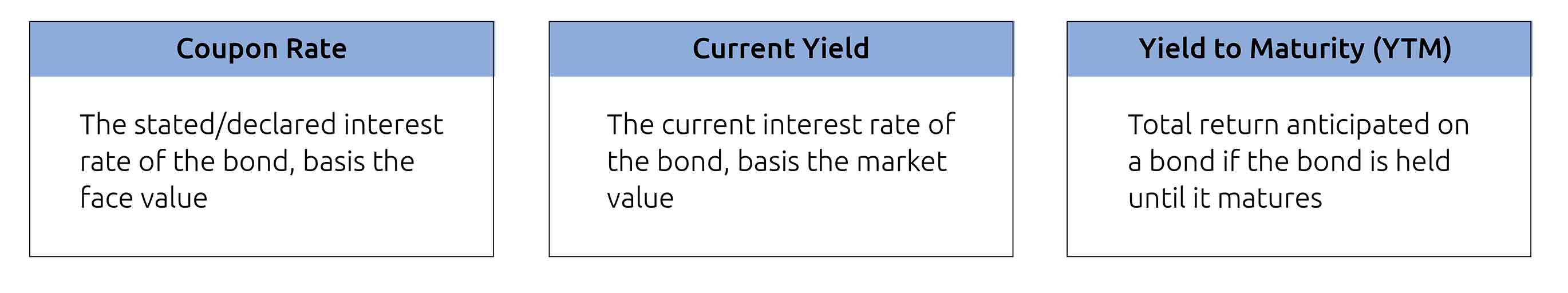

Coupon rate and market rate. Bond Price Calculator Coupon rate is the annual rate of return the bond generates expressed as a percentage from the bond's par value. Coupon rate compounding frequency that can be Annually, Semi-annually, Quarterly si Monthly. Market interest rate represents the return rate similar bonds sold on the market can generate. Bond's Price, Coupon Rate, Maturity | CFA Level 1 - AnalystPrep Price versus Coupon Rate. When the coupon rate is greater than the market discount rate, the bond is priced at a premium above par value. Conversely, when the coupon rate is less than the market discount rate, the bond is priced at a discount below par value. All else equal, the price of a lower coupon bond is more volatile than that of a ... Difference Between Coupon Rate and Interest Rate The main difference between Coupon Rate and Interest Rate is that the coupon rate has a fixed rate throughout the life of the bond. Meanwhile, the interest rate changes its rate according to the bond yields. The coupon rate is the annual rate of the bond that has to be paid to the holder. Coupon Rate of a Bond - WallStreetMojo In short, the coupon rate is influenced by the market interest rates and the issuer's creditworthiness. Relevance and Uses Coupon Rate is referred to the stated rate of interest on fixed income securities such as bonds. In other words, it is the rate of interest that the bond issuers pay to the bondholders for their investment.

Bond Stated Interest Rate Vs. Market Rate | Pocketsense Because of the manner in which bonds are traded, the coupon rate often differs from the market interest rate. Tips A coupon rate is a fixed rate of return attached to the face value of the bond paid to the purchaser from the seller, while the market interest rate can change dramatically throughout the lifespan of the bond. Bond Basics Finance exam 2 Flashcards | Quizlet The coupon rate determines the periodic interest payments made to investors. YTM is the expected return for an investor who buys the bond today and holds it to maturity. YTM is the prevailing market interest rate for bonds with similar features. Which of the following terms apply to a bond? Coupon rate Dividend yield Time to maturity Par value What is 'Coupon Rate' - The Economic Times The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 bond with a coupon rate of 10 per cent, you will get Rs 200 every year for 10 years, no matter what happens to the bond price in the market. What Is the Coupon Rate of a Bond? - The Balance ABC bond's coupon rate was 3%, based on a par value of $1,000 for the bond. This translates to $30 of interest paid each year. Let's say Investor 1 purchases the bond for $900 in the secondary market but still receives the same $30 in interest. This translates to a current yield of 3.33%.

Coupon Rate vs Interest Rate | Top 6 Best Differences (With ... - EDUCBA The key difference between coupon rate vs interest rate is that interest rate is generally and in most of the cases are related to plain vanilla debt like term loans and other kinds of debt which are availed by companies and individuals for various business requirements. Chapter 4 - Valuation and Bond Analysis - Business Finance Essentials This will always be the case - when the market rate of interest equals the coupon rate, the bond price will trade at par value ($1000). Now, how much will prices fall if the market rate of interest falls to 7%. This time you should get $126.93 for the zero and $1124.72 for the 8% coupon. Note that the decline in interest rates caused the zero ... Understanding Coupon Rate and Yield to Maturity of Bonds When bonds are initially issued in the primary market, the Coupon Rate is based on current market rates, hence YTM is equal to the Coupon Rate. In the example bond above, when you bought the 3-year RTB issued at the primary market, your YTM and Coupon Rate is 2.375%. Now, what if you bought the security in the secondary market? Important Differences Between Coupon and Yield to Maturity - The Balance Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate.

Coupon Rate Calculator | Bond Coupon The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%.

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Coupon Rate = Reference Rate + Quoted Margin The quoted margin is the additional amount that the issuer agrees to pay over the reference rate. For example, suppose the reference rate is a 5-year Treasury Yield, and the quoted margin is 0.5%, then the coupon rate would be - Coupon Rate = 5-Year Treasury Yield + .05%

What Is Coupon Rate and How Do You Calculate It? - SmartAsset The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. In our example above, the $1,000 pays a 10% interest rate. Investors use the phrase "coupon rate" for two reasons.

Coupon Rate vs Interest Rate | Top 8 Best Differences (with Infographics) If the investor purchases a bond of 10 years, of the face value of $1,000, and a coupon rate of 10 percent, then the bond purchaser gets $100 every year as coupon payments on the bond. If a bank has lent $ 1000 to a customer and the interest rate is 12 percent, then the borrower will have to pay charges $120 per year.

What is the difference between coupon rate and market - Course Hero The discount rate is useful in determining the current value of money. Market rate of return is different from discount rate, (if the market rate of returns is equal to the value which is formulated from the results of the discount method), then the source is fairly traded.

Coupon rate - definition and meaning - Market Business News Coupon rate - example. Assume that a bond has a par value of $5,000 and a coupon rate of 5%. This would make total annual coupon payments equal to $250. For the typical bond, the bondholder would receive $125 twice a year. Overall, investors tend to prefer bonds with higher coupon rates. However, not every bond has a coupon.

A Bond's Price given a Market Discount Rate - AnalystPrep Now, what if the coupon rate changed to 6%, paid annually, and the market discount rate remains at 6%. Then, the price of the bond would be 100, and the bond would be trading at par. ... depends on the relationship between the coupon rate (Cr) and market discount rate (Mdr). In a summary: If Cr < Mdr, then the bond is priced at a discount below ...

Difference Between Coupon Rate and Required Return Coupon Rate is the periodical price that the buyer receives until the bond matures. Required Return is the amount paid for the investor to own the risks. The coupon rate is calculated using the formula Coupon rate = ( Total annual payment/par value of bond) * 100. Required Return is calculated by using the beta value.

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate = 20% Now, if the market rate of interest is lower than 20% than the bond will be traded at a premium as this bond gives more value to the investors compared to other fixed income securities. However, if the market rate of interest is higher than 20%, then the bond will be traded at discount. Coupon Rate Formula - Example #2

TMBMKGB-30Y | U.K. 30 Year Gilt Overview | MarketWatch TMBMKGB-30Y | A complete U.K. 30 Year Gilt bond overview by MarketWatch. View the latest bond prices, bond market news and bond rates.

Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity...

Coupon Rate Formula & Calculation - Study.com Examples of How to Calculate Coupon Rate. Company ABZ is raising capital for its new project by issuing bonds in the capital market. The company is issuing 20,000 bonds at $1,000 par value that ...

Coupon Rate - Meaning, Calculation and Importance - Scripbox To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds Bonds pay interest to their holders.

What is a Coupon Rate? - Definition | Meaning | Example In order to calculate the coupon rate formula of a bond, we need to know: the face value of the bond, the annual coupon rate, and the number of periods per annum. Let's look at an example. Example. The coupon payment on each bond is $1,000 x 8% = $80. So, Georgia will receive $80 interest payment as a bondholder.

/interest_rate_istock496445100-5bfc47a6c9e77c002636cbdc.jpg)

Post a Comment for "44 coupon rate and market rate"