39 how to calculate a bond's coupon rate

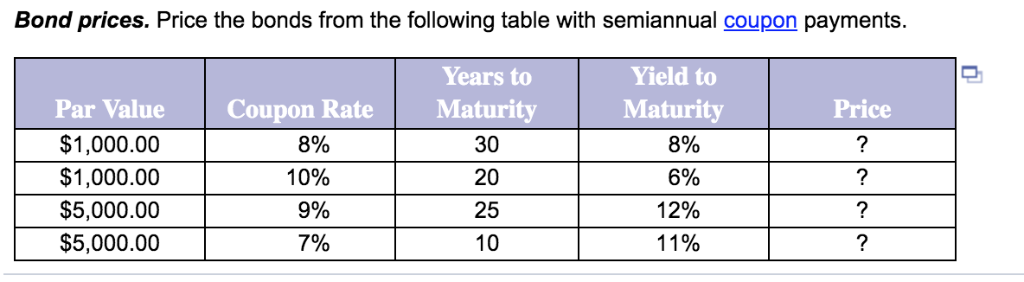

Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM). Coupon Rate Formula & Calculation - Study.com To calculate the coupon rate, these steps should be followed: Identify the par value of the bond. Usually, the par value of the bond equals $1,000. However, some bonds have par values that are...

How Can I Calculate a Bond's Coupon Rate in Excel? Jul 19, 2021 · In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. For example, if a...

How to calculate a bond's coupon rate

Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000... Principal of a Bond | Definition | Finance Strategists The principal of the bond, also called its face value or par value, refers to the amount of money the issuer agrees to pay the lender at the bond's expiration. The principal of a bond is usually either $100 or $1000, but on the open market, bonds may also trade at a premium or discount on this price. The coupon rate is the percentage of the ... Basics Of Bonds - Maturity, Coupons And Yield Current yield is the bond's coupon yield divided by its market price. To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010).

How to calculate a bond's coupon rate. Where to find yield to maturity? Explained by FAQ Blog A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. ... To calculate the YTM, just enter the bond data into the TVM keys. We can find the YTM by solving for I/Y. Enter 6 into N, -961.63 into PV, 40 into PMT, and 1,000 into FV. Now, press CPT I/Y and you ... Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision For example, suppose the reference rate is a 5-year Treasury Yield, and the quoted margin is 0.5%, then the coupon rate would be -. Coupon Rate = 5-Year Treasury Yield + .05%. So if the 5-Year Treasury Yield is 7%, then the coupon rate for this security will be 7.5%. Now, if this coupon is revised every six months and after six months, the 5 ... Bond Basics: Issue Size and Date, Maturity Value, Coupon Coupon and Yield to Maturity . The coupon rate is the periodic interest payment that the issuer makes during the life of the bond. For instance, a bond with a $10,000 maturity value might offer a coupon of 5%. Then, you can expect to receive $500 each year until the bond matures. What Is the Coupon Rate of a Bond? Coupon Rate Formula The formula to calculate a bond's coupon rate is very straightforward, as detailed below. The annual interest paid divided by bond par value equals the coupon rate. As an example, let's say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate.

How to Find Coupon Rate of a Bond on Financial Calculator Once you have this information, you can follow these steps to calculate the coupon rate: 1) Enter the face value of the bond into the calculator. 2) Enter the coupon rate into the calculator. 3) Enter the number of years until the bond matures into the calculator. 4) Enter the market interest rate into the calculator. Bond Yield: Definition & Calculation with Interest Rates Coupon rate: the bond's interest rate which is a percentage of the bond's face value; for example, if a bond has a coupon rate of 5% and a face value of $1,000, it will pay $50 in interest annually Bond Pricing - Formula, How to Calculate a Bond's Price The number of periods will equal the number of coupon payments. The Time Value of Money Bonds are priced based on the time value of money. Each payment is discounted to the current time based on the yield to maturity (market interest rate). The price of a bond is usually found by: P (T0) = [PMT (T1) / (1 + r)^1] + [PMT (T2) / (1 + r)^2] … How To Calculate YTM (Years To Maturity) On A Financial Calculator YTM is a measure of the expected return on a bond. It is calculated by first finding the current yield, then adding in the coupon rate. The current yield is found by dividing the annual interest payment by the current price of the bond. The coupon rate is found by dividing the annual interest payment by the face value of the bond.

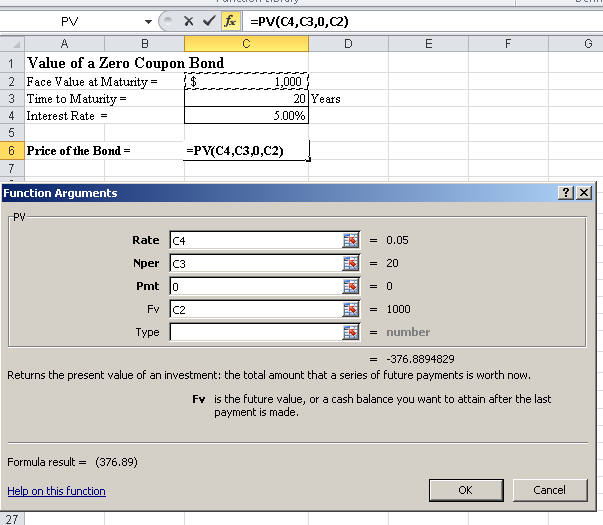

How do I Calculate Zero Coupon Bond Yield? (with picture) The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check. Bond Yield: Definition, Formula, Understanding How They Work The coupon yield — or coupon rate — is the interest you earn annually from a bond. For example, if you bought a bond for $100 and earned $5 in interest per year, that bond would have a 5% ... Bond Valuation: Formula, Steps & Examples - Study.com A bond's present value (price) is determined by the following formula: Price = {Coupon_1}/ { (1+r)^1} + {Coupon_2}/ { (1+r)^2} + ... + {Coupon_n}/ { (1+r)^n} + {Face Value}/ { (1+r)^n} For example,... smartasset.com › investing › bond-coupon-rateWhat Is Coupon Rate and How Do You Calculate It? Dec 03, 2019 · To calculate the bond coupon rate we add the total annual payments then divide that by the bond’s par value: ($50 + $50) = $100; The bond’s coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond’s interest rate.

Quant Bonds - Between Coupon Dates - BetterSolutions.com You can calculate the price of a bond for dates between coupon dates by 1) Using the PRICE function. 2) Using the YIELD function - uses clean price as an argument SS What is the Clean Price ? Also known as the Flat Price, Quoted Price This is the price excluding any accrued income Traders usually quote clean prices What is the Accrued Interest ?

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The issuer makes periodic interest payments until maturity when the bondholder's initial investment - the face value (or "par value") of the bond - is returned to the bondholder. Formula for Calculating the Coupon Rate Where: C = Coupon rate i = Annualized interest P = Par value, or principal amount, of the bond Download the Free Template

Coupon Rate Calculator | Bond Coupon Jan 12, 2022 · You can find it by dividing the annual coupon paymentby the face value: coupon rate = annual coupon payment / face value. For Bond A, the coupon rateis $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time!

How Do I Determine the Fair Value of a Bond? (with picture) The formula used to do so is as follows: P = C/ (1+r) + C/ (1+r)^2 + . . . + C/ (1+r)^n + M/ (1+r)^n, where P is the fair value, C is the coupon, r is the discount rate, n is the number of complete years to maturity, and M is the par value. To illustrate, is helps to consider a bond that has $1,000 USD par value, pays $100 coupon per year, with ...

Definition of Bond Discount Rate | Pocketsense The present value formula is: 1/ (1+r)^n, where r equals the discount rate (10 percent) and n equals the time period (1). Therefore, the present value factor equals 1/ (1+ 0.10)^1, or 0.9091. The present value is therefore equal to 0.9091 multiplied by $110, or $100.

Coupon Rate - Meaning, Calculation and Importance - Scripbox To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds Bonds pay interest to their holders.

› coupon-rate-bondCoupon Rate of a Bond (Formula, Definition) | Calculate ... The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

How to Calculate the Fair Value of a Bond | Sapling To calculate the fair interest rate of a bond, use the following formula. To do so, you'll need the bond's fair present value (FV bond), which is what it is worth currently. The formula for the fair interest rate of a bond is as follows: Fair interest rate = Coupon payment amount / FV of bond. Consider also: Bond Stated Interest Rate Vs.

How to Calculate Interest Payments on Bonds | Pocketsense Brought to you by Sapling. Suppose the coupon rate for a $1,000 bond is 6 percent . Divide 6 percent in half and multiply by $1,000 . The interest payment is $30 every six months . Corporate bonds usually pay higher interest rates than government bonds because they carry more risk.

Bond Pricing | Valuation | Formula | How to calculate with example | eFM Calculate the price of a bond whose face value is $1000. The coupon rate is 10% and will mature after 5 years. The required rate of return is 8%. Coupon payment every year is $1000*10% = $100 every year for a period of 5 years. Hence, Therefore, the value of the bond (V) = $1079.8 The following is the summary of bond pricing:

How to calculate the present value of a bond - AccountingTools Go to a present value of $1 table and locate the present value of the bond's face amount. In this case, the present value factor for something payable in five years at a 6% interest rate is 0.7473. Therefore, the present value of the face value of the bond is $74,730, which is calculated as $100,000 multiplied by the 0.7473 present value factor.

Basics Of Bonds - Maturity, Coupons And Yield Current yield is the bond's coupon yield divided by its market price. To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010).

Principal of a Bond | Definition | Finance Strategists The principal of the bond, also called its face value or par value, refers to the amount of money the issuer agrees to pay the lender at the bond's expiration. The principal of a bond is usually either $100 or $1000, but on the open market, bonds may also trade at a premium or discount on this price. The coupon rate is the percentage of the ...

Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000...

:max_bytes(150000):strip_icc()/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "39 how to calculate a bond's coupon rate"