43 how to determine coupon rate

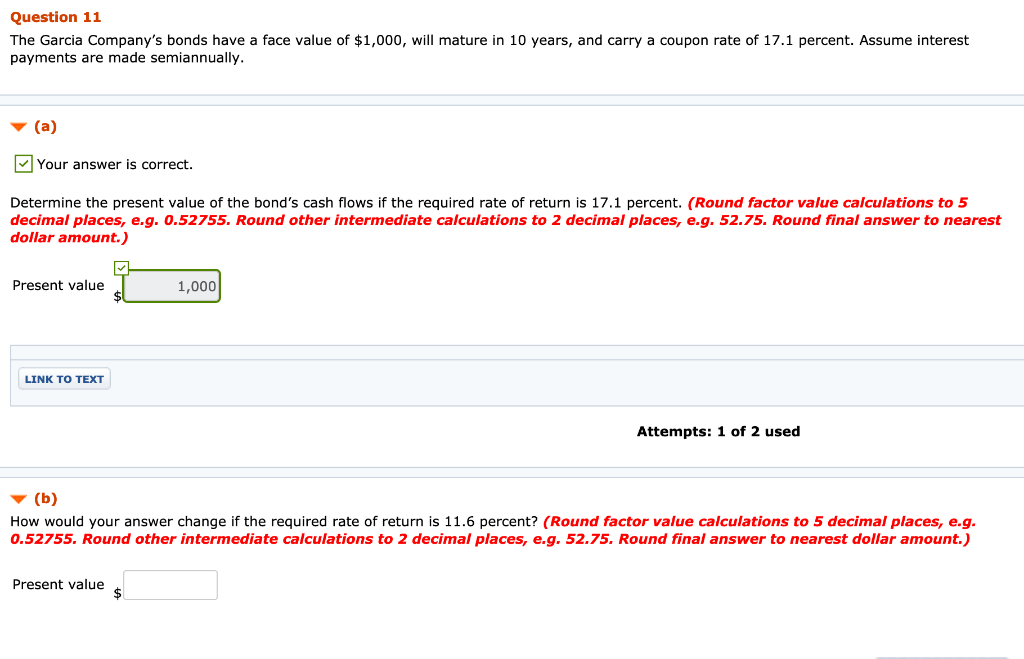

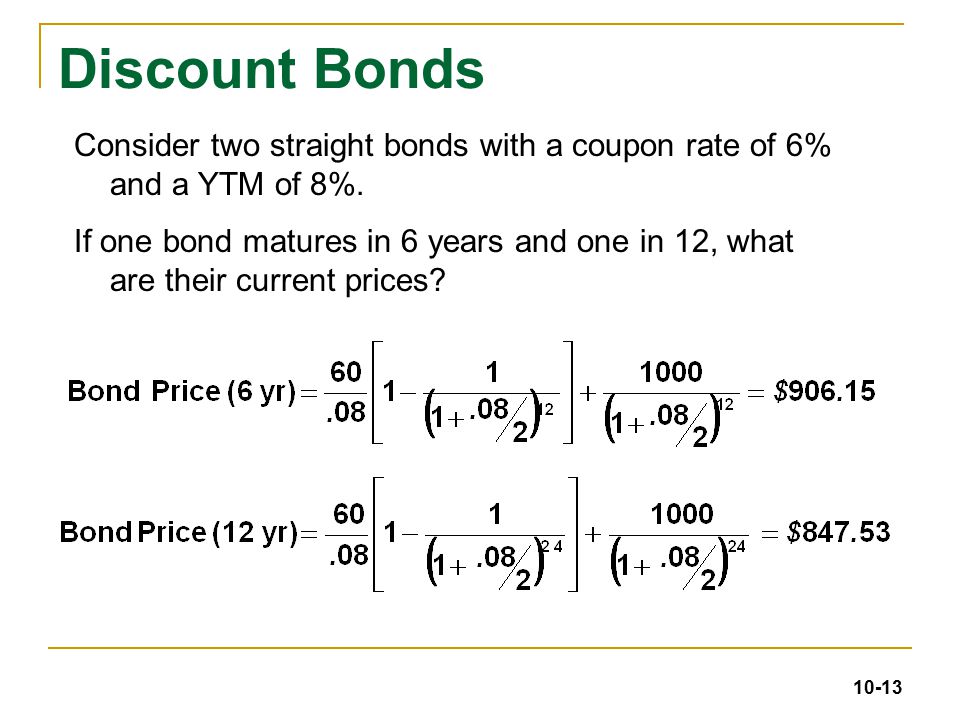

Assignment Essays - Best Custom Writing Services Best Custom Writing Services. Need help with your assignment essay? We got you covered! We have helped thousands of students with their Essays, Assignments, Research Papers, Term Papers, Theses, Dissertations, Capstone Projects, etc. How To Find Coupon Rate Of A Bond On Financial Calculator Once you have this information, you can follow these steps to calculate the coupon rate: 1) Enter the face value of the bond into the calculator. 2) Enter the coupon rate into the calculator. 3) Enter the number of years until the bond matures into the calculator. 4) Enter the market interest rate into the calculator.

Interest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data

How to determine coupon rate

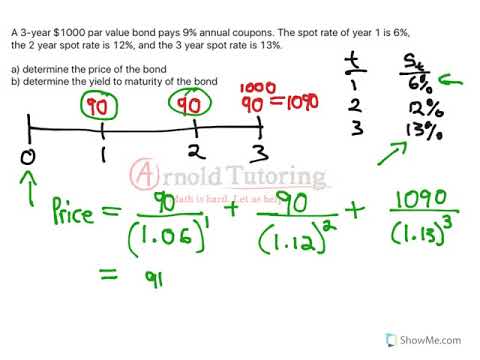

What Is the Coupon Rate of a Bond? - The Balance 18/11/2021 · The bond’s coupon rate can also help an investor determine the bond’s yield if they are purchasing the bond on the secondary market. The fixed dollar amount of interest can be used to determine the bond’s current yield, which will help show if … Coupon Rate vs. Discount Rate - What's The Difference (With Table) Let us look at the formula to calculate the yield to maturity when there is no inclusion of coupons:- [ (Yield To Maturity)+1]t=Face valuePresent Value Now if we estimate it to calculate the exact value of YTM, we write Yield To Maturity=tFace valuePresent Value-1 Where t= Number of years left for maturity Face value= The maturity value of the bond PPIC Statewide Survey: Californians and Their Government 26/10/2022 · Key findings include: Proposition 30 on reducing greenhouse gas emissions has lost ground in the past month, with support among likely voters now falling short of a majority. Democrats hold an overall edge across the state's competitive districts; the outcomes could determine which party controls the US House of Representatives. Four in ten likely voters are …

How to determine coupon rate. Coupon Rate - Explained - The Business Professor, LLC How to Calculate Coupon Rate. Generally, investors will always prefer bonds that have a high coupon rate over those with low coupon rates, not unless they are all held equal. To calculate the coupon rate, you first have to divide the sum of the security's yearly coupon payment. You then divide them by the par value of the bond. Internal Rate of Return (IRR) Rule: Definition and Example 24/08/2022 · Internal Rate of Return - IRR: Internal Rate of Return (IRR) is a metric used in capital budgeting to estimate the profitability of potential investments. Internal rate of return is a discount ... Coupon Rate Formula | Simple Accounting A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value.As a simple example, consider a zero coupon bond with a face, or par, value of $1200, and a maturity of one year. Publication 15-B (2022), Employer's Tax Guide to Fringe Benefits Under this rule, you determine the value of a vehicle you provide to an employee for personal use by multiplying the standard mileage rate by the total miles the employee drives the vehicle for personal purposes. Personal use is any use of the vehicle other than use in your trade or business. This amount must be included in the employee's wages or reimbursed by the …

Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of... What is Coupon Rate? Definition of Coupon Rate, Coupon Rate Meaning ... Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 bond with a coupon rate of 10 ... Interest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are … What Are Returns in Investing, and How Are They Measured? 27/08/2021 · Return: A return is the gain or loss of a security in a particular period. The return consists of the income and the capital gains relative on an investment, and it is usually quoted as a ...

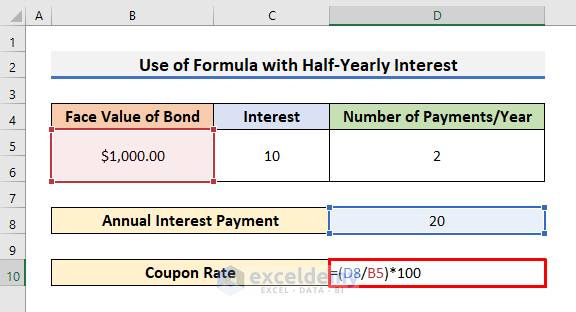

Publication 15 (2022), (Circular E), Employer's Tax Guide For Medicare taxes: employer rate of 1.45% plus 20% of the employee rate of 1.45%, for a total rate of 1.74% of wages. For Additional Medicare Tax: 0.18% (20% of the employee rate of 0.9%) of wages subject to Additional Medicare Tax. For federal income tax withholding, the rate is 1.5% of wages. Zero-Coupon Bond - Definition, How It Works, Formula To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or interest rate; and n is the number of years until maturity. Note that the formula above assumes that the interest rate is compounded annually. Calculate the Coupon Rate of a Bond - YouTube This video explains how to calculate the coupon rate of a bond when you are given all of the other terms (price, maturity, par value, and YTM) with the bond ... Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate...

Publication 15-B (2022), Employer's Tax Guide to Fringe ... Cents-per-mile rule. The business mileage rate for 2022 is 58.5 cents per mile. You may use this rate to reimburse an employee for business use of a personal vehicle, and under certain conditions, you may use the rate under the cents-per-mile rule to value the personal use of a vehicle you provide to an employee.

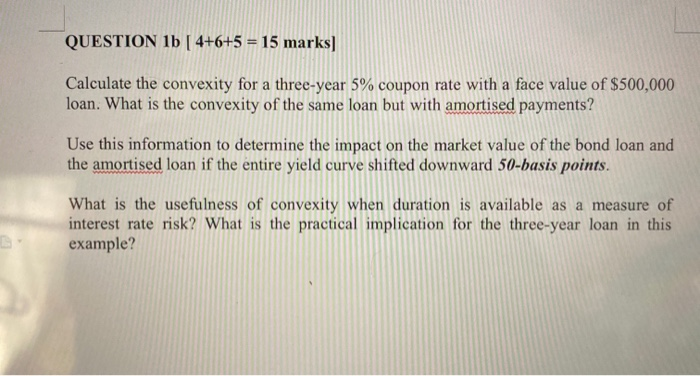

Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

Coupon Rate and Yield to Maturity | How to Calculate Coupon Rate The coupon rate represents the actual amount of interest earned by the bondholder annually while the yield to maturity is the estimated total rate of return of a bond, assuming that it is...

Understanding Coupon Rate and Yield to Maturity of Bonds Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: Security Name. Coupon Rate. Maturity Date. RTB 03-11. 2.375%. 3/9/2024. The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes. The frequency of payment depends on the type of fixed income security.

Could Call of Duty doom the Activision Blizzard deal? - Protocol Oct 14, 2022 · Hello, and welcome to Protocol Entertainment, your guide to the business of the gaming and media industries. This Friday, we’re taking a look at Microsoft and Sony’s increasingly bitter feud over Call of Duty and whether U.K. regulators are leaning toward torpedoing the Activision Blizzard deal.

Coupon rate definition — AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond. For example, if an investor pays less than the face amount of a bond, the current yield ...

Politics | Fox News Presidential politics and political news from foxnews.com. News about political parties, political campaigns, world and international politics, politics news headlines plus in-depth features and ...

Coupon Rate Formula & Calculation - Study.com To calculate the coupon rate of ABZ, the steps discussed in the coupon rate formula should be followed. Identify the par value of the bond: In this example, ABZ is issuing bonds with a $1,000 par ...

Coupon Rate - Meaning, Calculation and Importance - Scripbox Coupon rates are a percentage of the bond's face value (par value) and are set while issuing the bond. Moreover, the coupon payments are fixed for a bond throughout its tenure. Coupon Rate = (Total Annual Interest Payments / Face Value of the Bond) * 100 Let's understand couponrate calculation with the help of an example.

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 For Secured NCDs Coupon Rate = (89 / 1000) * 100 Coupon Rate= 8.9% For Unsecured NCDs Coupon Rate = (91 / 1000) * 100 Coupon Rate= 9.1%

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Coupon Rate = Reference Rate + Quoted Margin The quoted margin is the additional amount that the issuer agrees to pay over the reference rate. For example, suppose the reference rate is a 5-year Treasury Yield, and the quoted margin is 0.5%, then the coupon rate would be - Coupon Rate = 5-Year Treasury Yield + .05%

What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

Stock Quotes, Business News and Data from Stock Markets | MSN … 23/11/2022 · Get the latest headlines on Wall Street and international economies, money news, personal finance, the stock market indexes including Dow Jones, NASDAQ, and more. Be informed and get ahead with ...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Formula for Calculating the Coupon Rate Where: C = Coupon rate i = Annualized interest P = Par value, or principal amount, of the bond Download the Free Template Enter your name and email in the form below and download the free template now! How the Coupon Rate Affects the Price of a Bond All types of bonds pay interest to the bondholder.

How to Measure the ROI of Discount Coupons? - Voucherify With Voucherify, you can build the following coupon types: Amount (e.g. $10 off) Percentage (e.g. 20% off) Unit (e.g. 2 free piano classes) Free shipping Fixed amount Dynamic discounts Once the digital coupon code is created, the tracking is super simple. In this case, you just monitor the number of redemptions.

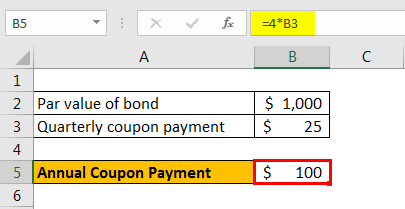

Coupon Payment Calculator You can quickly calculate the coupon payment for each payment period using the coupon payment formula: Coupon payment = face value * (annual coupon rate / number of payments per year) = $1,000 * (10% / 2) = $1,000 * 5% = $50

What Is a Coupon Rate? How To Calculate Them & What They're Used For How Do You Calculate the Coupon Rate? Let's take a look at the formula for calculating the coupon rate and how we can apply them. Simple Formula C = I/P Where: C = coupon rate I = annualized interest P = par value The coupon rate is the rate by which the bond issuer pays the bondholder.

How to Calculate a Coupon Payment: 7 Steps (with Pictures) - wikiHow Find the bond coupon rate. The coupon rate is usually expressed as a percentage (e.g., 8%). [4] You'll need this information, also provided by your broker, to calculate the coupon payment. 4 Get the current yield, if available. The current yield will show you your return on your bond investment, exclusive of capital gains. [5]

Coupon Rate Calculator | Bond Coupon Calculate the coupon rate. The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value. For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate ...

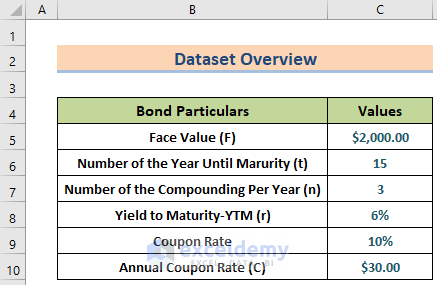

How to Calculate Bond Price in Excel (4 Simple Ways) Method 1: Using Coupon Bond Price Formula to Calculate Bond Price. Users can calculate the bond price using the Present Value Method (PV). In the method, users find the present value of all the future probable cash flows. Present Value calculation includes Coupon Payments and face value amount at maturity. The typical Coupon Bond Price formula is

Assignment Essays - Best Custom Writing Services Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply.

Unbanked American households hit record low numbers in 2021 25/10/2022 · Those who have a checking or savings account, but also use financial alternatives like check cashing services are considered underbanked. The underbanked represented 14% of U.S. households, or 18. ...

What Is the Coupon Rate of a Bond? - The Balance Nov 18, 2021 · The bond’s coupon rate can also help an investor determine the bond’s yield if they are purchasing the bond on the secondary market. The fixed dollar amount of interest can be used to determine the bond’s current yield, which will help show if this is a good investment for them.

Coupon Rate: Formula and Bond Calculation - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the interest rate pricing on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6%

Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator Online coupon rate calculation. Use this simple finance coupon rate calculator to calculate coupon rate.

How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia For example, if a bond has a par value of $1,000 and generates two $30 coupon payments each year, the coupon rate is ($30 x 2) ÷ $1,000, or 0.06. Once the cell ...

Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond's par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates, etc, Please provide us with an attribution link

INDIRECT COST RATE GUIDE FOR NON-PROFIT ORGANIZATIONS Determine Indirect Cost Rate Structure: Determine which method is best for the organization, i.e., direct cost allocation or simplified, and whether special indirect cost rates are required, i.e. on-site, off-site, fringe benefit rate for full-time vs. part-time. In selecting the appropriate method, the organization should consider the following: a. Organizational structure b. Level of Federal ...

PPIC Statewide Survey: Californians and Their Government 26/10/2022 · Key findings include: Proposition 30 on reducing greenhouse gas emissions has lost ground in the past month, with support among likely voters now falling short of a majority. Democrats hold an overall edge across the state's competitive districts; the outcomes could determine which party controls the US House of Representatives. Four in ten likely voters are …

Coupon Rate vs. Discount Rate - What's The Difference (With Table) Let us look at the formula to calculate the yield to maturity when there is no inclusion of coupons:- [ (Yield To Maturity)+1]t=Face valuePresent Value Now if we estimate it to calculate the exact value of YTM, we write Yield To Maturity=tFace valuePresent Value-1 Where t= Number of years left for maturity Face value= The maturity value of the bond

What Is the Coupon Rate of a Bond? - The Balance 18/11/2021 · The bond’s coupon rate can also help an investor determine the bond’s yield if they are purchasing the bond on the secondary market. The fixed dollar amount of interest can be used to determine the bond’s current yield, which will help show if …

Post a Comment for "43 how to determine coupon rate"